The FED’s Hawkish Stance Flattens US Treasury Yields this Week

The BLOM Bond Index (BBI) declined by a weekly 0.36% to settle at 105.57 points this week. The performance of emerging bonds continued to be subdued, with the JP Morgan Emerging Markets’ Bond Index (EMBI) registering a 0.5% downtick to 786.65 points.

The yields on the Lebanese Eurobonds maturing in 5 and 10 years rose to 5.80% and 6.63% from last week’s 5.69% and 6.56%, respectively.

In the US, the yield on the 5 year treasuries stabilized at last week’s 1.76%, while the yield on the 10 year treasuries marginally slid from 2.16% to 2.15%. Overall, US treasury yields flattened over the week as the FED faced criticism regarding the hawkish stance it adopted last week, lifting interest rates by a quarter points against a backdrop of weak inflation and tepid growth.

The 5 and 10 year spreads between the Lebanese Eurobonds’ yields and the US treasuries widened from 393 bps to 404 bps and 440 bps to 448 bps , respectively.

5 Year Credit Default Swaps, Mid-Prices (in basis points)

| 22/06/2017 | 15/06/2017 | |

| Lebanon | 403 | 381 |

| KSA | 109 | 100 |

| Dubai | 130 | 120 |

| Brazil | 243 | 236 |

| Turkey | 189 | 186 |

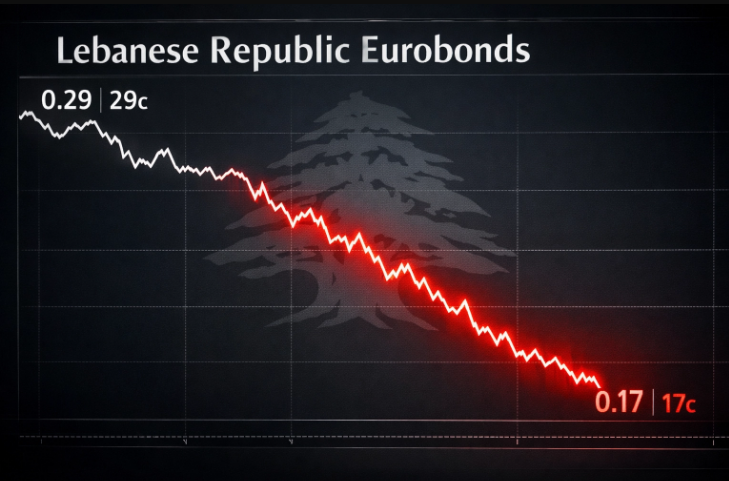

Weekly Change of Lebanese Eurobonds Prices

| Prices | Weekly | Yields | Weekly | ||||

| Maturity | Coupon in % | 22/06/2017 | 15/06/2017 | Change | 22/06/2017 | 15/06/2017 | Change bps |

| 12/06/2018 | 5.15 | 100.75 | 100.75 | 0.00% | 4.35% | 4.37% | -2 |

| 12/11/2018 | 5.15 | 101 | 101 | 0.00% | 4.40% | 4.41% | -1 |

| 23/04/2019 | 5.5 | 101 | 101.13 | -0.13% | 4.92% | 4.85% | 7 |

| 20/05/2019 | 6 | 101.75 | 102 | -0.25% | 5.03% | 4.90% | 13 |

| 28/11/2019 | 5.45 | 100.75 | 101 | -0.25% | 5.12% | 5.01% | 11 |

| 09/03/2020 | 6.375 | 102.38 | 102.75 | -0.36% | 5.42% | 5.28% | 14 |

| 14/04/2020 | 5.8 | 100.88 | 101.25 | -0.37% | 5.45% | 5.32% | 14 |

| 19/06/2020 | 6.15 | 101.75 | 102.13 | -0.37% | 5.51% | 5.37% | 13 |

| 12/04/2021 | 8.25 | 108.88 | 109.25 | -0.34% | 5.62% | 5.53% | 9 |

| 04/10/2022 | 6.1 | 101.13 | 101.63 | -0.49% | 5.85% | 5.74% | 11 |

| 27/01/2023 | 6 | 100.38 | 100.5 | -0.12% | 5.92% | 5.89% | 3 |

| 22/04/2024 | 6.65 | 102 | 102.38 | -0.37% | 6.28% | 6.22% | 7 |

| 04/11/2024 | 6.25 | 99.63 | 100 | -0.37% | 6.31% | 6.25% | 6 |

| 03/12/2024 | 7.00 | 104 | 104.38 | -0.36% | 6.32% | 6.26% | 6 |

| 26/02/2025 | 6.20 | 99.13 | 99.5 | -0.37% | 6.34% | 6.28% | 6 |

| 12/06/2025 | 6.25 | 99.25 | 99.63 | -0.38% | 6.37% | 6.31% | 6 |

| 28/11/2026 | 6.60 | 100.75 | 101.25 | -0.49% | 6.49% | 6.42% | 7 |

| 23/03/2027 | 6.85 | 101.63 | 102.13 | -0.49% | 6.62% | 6.55% | 7 |

| 29/11/2027 | 6.75 | 100.75 | 101.25 | -0.49% | 6.65% | 6.58% | 7 |

| 03/11/2028 | 6.65 | 99.38 | 100 | -0.62% | 6.73% | 6.65% | 8 |

| 26/02/2030 | 6.65 | 99.13 | 99.63 | -0.50% | 6.75% | 6.69% | 6 |

| 22/04/2031 | 7.00 | 101 | 101.5 | -0.49% | 6.89% | 6.83% | 6 |

| 23/03/2032 | 7.00 | 101 | 101.5 | -0.49% | 6.89% | 6.84% | 5 |

| 02/11/2035 | 7.05 | 100.25 | 100.5 | -0.25% | 7.02% | 7.00% | 2 |

| 23/03/2037 | 7.25 | 101.25 | 101.75 | -0.49% | 7.13% | 7.08% | 5 |