Healthy Appetite for Lebanese Eurobonds on Wednesday

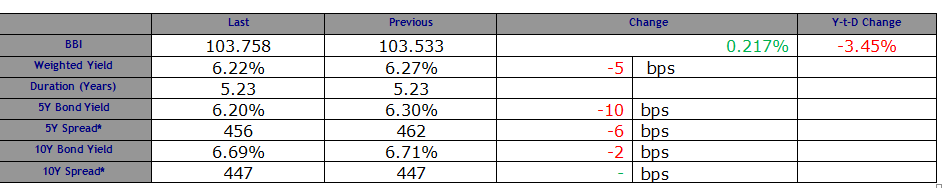

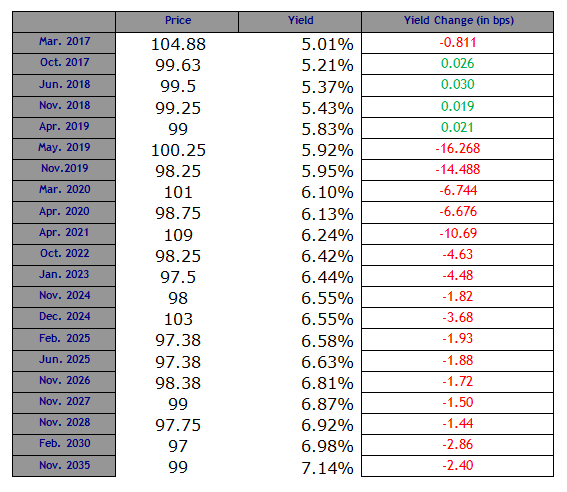

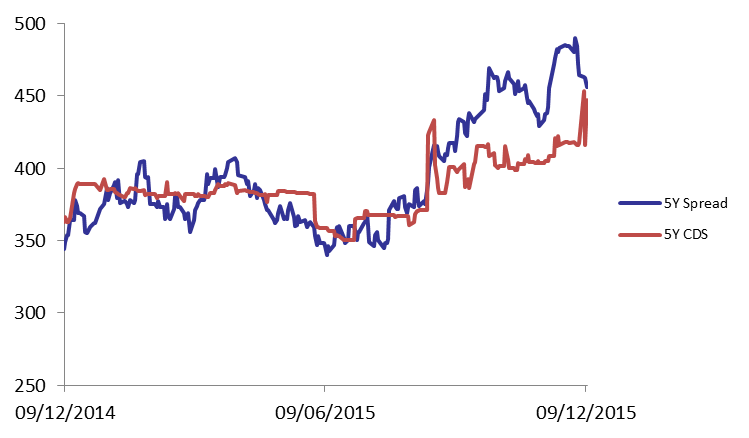

Demand for Lebanese Eurobonds progressed on Wednesday which caused the BLOM Bond Index (BBI) to increase by 0.22% to 103.76 points. The yields on the 5Y and 10Y Lebanese Eurobonds went down by 10 basis points (bps) and 2 bps to settle at 6.20% and 6.69%, respectively. In the US, demand for medium term maturities improved but at a slower pace than that of its Lebanese counterpart, causing the 5Y yield spread between both maturities to narrow by 6 bps to 456 bps. Meanwhile, the 5Y Credit Default Swaps widened from their previous quotes of 406-426 bps to 408-428bps.