Higher Appetite for the Lebanese Eurobonds Market on Monday

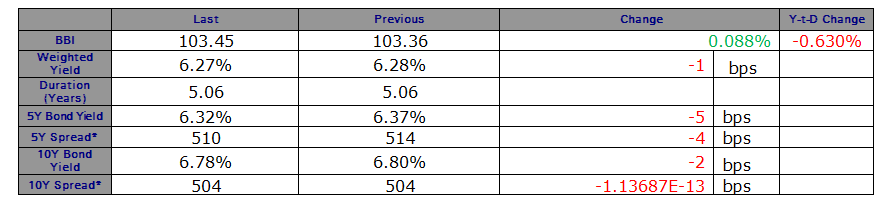

Demand for the Lebanese Eurobonds market increased on Monday as the BLOM Bond Index (BBI) gained a marginal 0.09% to 103.45 points.

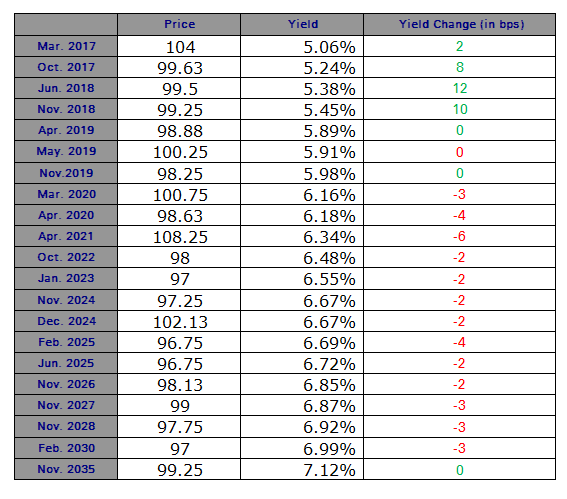

The yields on the 5Y and 10Y Lebanese Eurobonds dropped from 6.37% and 6.80% to 6.32% and 6.78%, respectively. In the U.S., demand for 5 Year treasury notes improved yesterday as their yield went down from 1.23% to 1.22%, thus the spread between the 5Y yield on the Lebanese Eurobonds and that of the US treasury notes narrowed by 4 bps to 510 bps.

Lebanon’s 5Y Credit Default Swaps (CDS) showed little change from their previous bid-ask range of 464-484 bps to 465-485 bps.