Lebanese Eurobonds Market Stabilized on Tuesday

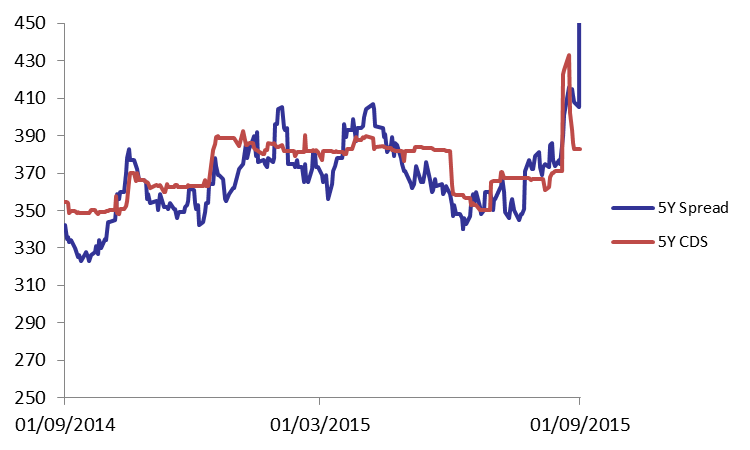

Demand for Lebanese Eurobonds barely changed on Tuesday, with the BLOM Bond Index (BBI) steadying at 105.89 points, and a year-to-date loss of 1.47%. Yields on the 5Y and 10Y Lebanese Eurobonds remained at 5.59% and 6.43%, respectively. On the other hand, the 5Y spread between Lebanese Eurobonds and their US counterpart widened by 5 basis points (bps), given that demand for U.S. medium term notes improved. As for the Lebanese 5Y Credit Default Swaps (CDS), they broadened from 370-395 bps to 368-397 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.892 | 105.892 | 0.00% | -1.47% | |

| Weighted Yield | 5.71% | 5.71% | 0 | bps | |

| Duration (Years) | 5.02 | 5.02 | |||

| 5Y Bond Yield | 5.59% | 5.59% | 0 | bps | |

| 5Y Spread* | 410 | 405 | 5 | bps | |

| 10Y Bond Yield | 6.43% | 6.43% | 0 | bps | |

| 10Y Spread* | 423 | 422 | 1 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.78 | 4.06% | 1 |

| Mar. 2017 | 106.5 | 4.61% | 0 |

| Oct. 2017 | 100.5 | 4.75% | 0 |

| Jun. 2018 | 100.75 | 4.86% | 0 |

| Nov. 2018 | 100.38 | 5.02% | 0 |

| Apr. 2019 | 100.75 | 5.27% | 0 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.63 | 5.64% | 0 |

| Apr. 2021 | 111 | 5.92% | 0 |

| Oct. 2022 | 100.75 | 5.97% | 0 |

| Jan. 2023 | 99.88 | 6.02% | 0 |

| Dec. 2024 | 105.75 | 6.17% | 0 |

| Feb. 2025 | 100 | 6.20% | 0 |

| Nov. 2026 | 100.75 | 6.50% | 0 |

| Nov. 2027 | 101.63 | 6.55% | 0 |

| Feb. 2030 | 100 | 6.65% | 0 |