Lebanese Eurobonds Market Started the Week in the Green

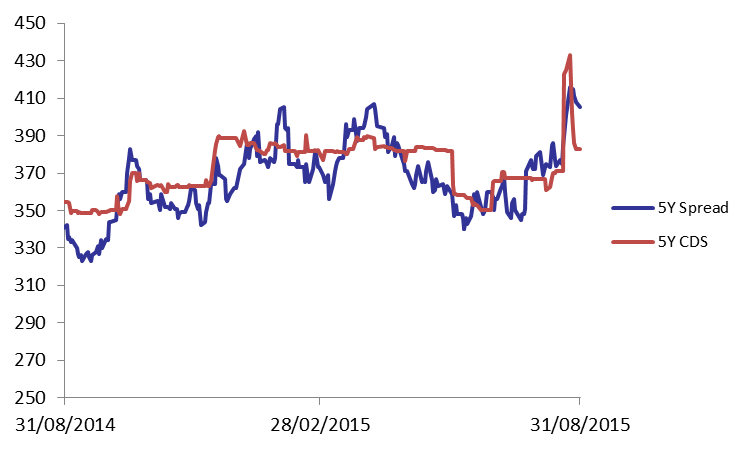

Demand for most Lebanese Eurobonds strengthened at the start of the week. The BLOM Bond Index (BBI) gained 0.16% to 105.89 points, narrowing its year-to-date loss to 1.47%. Yields on the 5Y and 10Y Lebanese Eurobonds dropped 1 basis point (bp) and 3 bps to 5.59% and 6.43%, respectively. On the other hand, demand for U.S. medium term notes decreased, contracting the 5Y spread between Lebanese Eurobonds and their US counterpart by 3 bps to 405 bps. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) steadied at 370-395 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.892 | 105.719 | 0.16% | -1.47% | |

| Weighted Yield | 5.71% | 5.74% | 4 | bps | |

| Duration (Years) | 5.02 | 5.03 | |||

| 5Y Bond Yield | 5.59% | 5.60% | -1 | bps | |

| 5Y Spread* | 405 | 408 | -3 | bps | |

| 10Y Bond Yield | 6.43% | 6.46% | -3 | bps | |

| 10Y Spread* | 422 | 427 | -5 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.79 | 4.05% | 0 |

| Mar. 2017 | 106.5 | 4.61% | -10 |

| Oct. 2017 | 100.5 | 4.75% | 0 |

| Jun. 2018 | 100.75 | 4.86% | 5 |

| Nov. 2018 | 100.38 | 5.02% | 0 |

| Apr. 2019 | 100.75 | 5.27% | -8 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.63 | 5.64% | 3 |

| Apr. 2021 | 111 | 5.92% | -5 |

| Oct. 2022 | 100.75 | 5.97% | 0 |

| Jan. 2023 | 99.88 | 6.02% | 0 |

| Dec. 2024 | 105.75 | 6.17% | -2 |

| Feb. 2025 | 100 | 6.20% | -11 |

| Nov. 2026 | 100.75 | 6.50% | -3 |

| Nov. 2027 | 101.63 | 6.55% | -5 |

| Feb. 2030 | 100 | 6.65% | -5 |