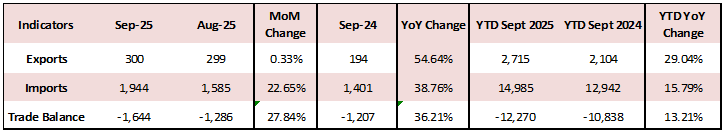

Lebanon’s Cumulative Trade Deficit Up by 13.21% YoY to $12.3B by September 2025

According to the Lebanese Customs Administration, Lebanon’s cumulative trade deficit increased by 13.21% year-over-year (YoY), to reach $12.3B by September 2025. This change was driven by a cumulative 15.79% YoY ($14,985 million) surge in imports by September 2025 despite a 29.04% YoY ($2,715 million) rise in exports during the same period.

The increase of Lebanon’s trade deficit has also been influenced by regional dynamics, notably Syria’s relative improvement in cross-border trade activity. As parts of the Syrian economy stabilize, trade routes have increasingly favored Syria as a transit and re-export hub, diverting some informal and formal trade flows away from Lebanon. This shift has reduced Lebanon’s role as a regional gateway while import demand remained strong. At the same time, security tensions along the southern border, higher imported inflation, and the absence of export-supporting policies continued to weigh on export competitiveness. Together, these factors reinforced Lebanon’s structural imbalance, allowing imports to outpace exports and pushing the cumulative trade deficit higher by September 2025.

Lebanon’s Balance of Trade (USD Million)

YTD: Year to Date

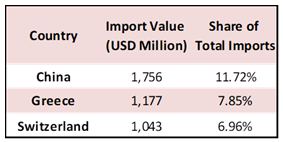

Top Import Destinations for Lebanon (YTD up to September 2025)

The top three import destinations in 2025 up till September were China, Greece, and Switzerland, accounting for 11.72%, 7.85%, and 6.96% of the total value of imports, respectively. The top imported products were mineral products (24.83%) at $3,721 million, pearls, precious stones, and metals (15.16%) at $2,272 million, and products of the chemical or allied industries (8.29%) at $1,243 million.

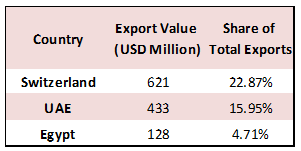

Top Export Destinations for Lebanon (YTD up to September 2025)

On the exports side, the top three destinations in 2025 up till September were Switzerland, United Arab Emirates (UAE) and Egypt capturing respective shares of 22.87%, 15.95% and 4.71% of the total value of exports. The top exported products were pearls, precious stones, and metals (36.10%) at $980 million, base metals and articles of base metal (14.77%) at $401 million, and prepared foodstuffs, beverages, and tobacco (11.71%) at $318 million.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.