Money Supply Determinants in Lebanon: August 2019-August 2022

The money supply M3 was traditionally used by economists to estimate the entire money supply within an economy and by central banks to direct monetary policy in order to control inflation, consumption, growth, and liquidity over medium and long-term periods.

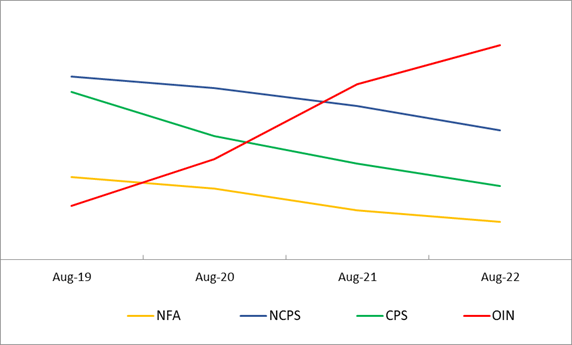

Accounting-wise, M3 includes currency in circulation as well as other financial products, specifically current and saving deposits. Analytically and more importantly, however, M3 is equal to the sum of Net Foreign Assets (NFA), Net Claims on the Public Sector (NCPS), Claims on the Private Sector (CPS), Other items net (OIN), and Valuation Adjustment. They reflect the economic determinants of M3.

M3= NFA + NCPS + CPS + OIN + VA

Counterparts of the Money Supply in Lebanon: August 2019-August 2022

| In Billions of LBP | Aug-19 | Aug-20 | Aug-21 | Aug-22 |

| Net Foreign Assets | 37,942 | 32,844 | 22,567 | 17,351 |

| of which Gold | 21,222 | 27,323 | 25,227 | 24,112 |

| Net Claims on the public sector | 84,549 | 79,236 | 70,892 | 59,628 |

| Valuation Adjustment | (12,979) | (18,857) | (17,923) | (17,640) |

| Claims on the Private sector | 77,443 | 57,023 | 44,251 | 33,983 |

| Claims in LBP | 24,503 | 22,416 | 19,399 | 16,679 |

| Claims in FC | 52,940 | 34,607 | 24,851 | 17,305 |

| Other Items (net) | 24,693 | 46,527 | 81,024 | 99,193 |

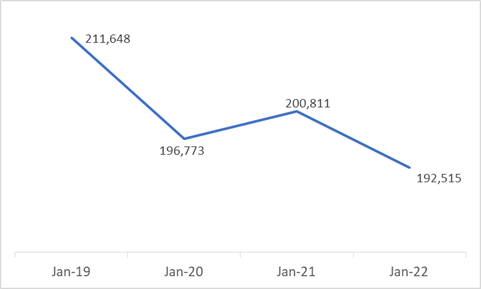

| Total | 211,648 | 196,773 | 200,811 | 192,515 |

Source: BDL; Blominvest

In Lebanon, BDL statistics reflect M3 and its determining components. As can be seen from the above table, M3 had actually fallen between August 2019 and August 2022: from around 211.6 trillion LBP to 192.5 trillion LBP. If we abstract from Valuations Adjustments, the main component that changed is Other Items Net that increased from 24.7 trillion LBP to 99.2 trillion LBP, and reflecting BDL’s open market operations and Seigniorage. However all other major components had fallen: Net Foreign Assets from 37.9 trillion LBP to 17.4 trillion LBP because of recurrent balance of payments deficits; Net Claims on the Public Sector from 84.5 trillion LBP to 59.6 trillion LBP as the reductions in government expenditures and increases in tax revenues (mostly VAT) produced budget surpluses that did not necessitate the issuing of more public debt; and Claims on the Private Sector from 77.4 trillion LBP to 34 trillion LBP because of the fall in credit and loans to the private sector.

The increase in Other Items Net is matched as a counterpart by the increase in currency in circulation, due to BDL’s intervention in the FX market (buying of USD) and because of BDL’s funding of circulars 151 and 158. But since, accounting-wise, M3 is equal to currency in circulation plus current and savings deposits, the increase in currency in circulation must have been outweighed by the reductions in deposits for M3 to fall during the period.

Money Supply Components, trend throughout the years

Source: BDL, BlomInvest

Money Supply M3, trend throughout the years

Source: BDL, BlomInvest