Positive Performance in the Lebanese Eurobonds Market Yesterday

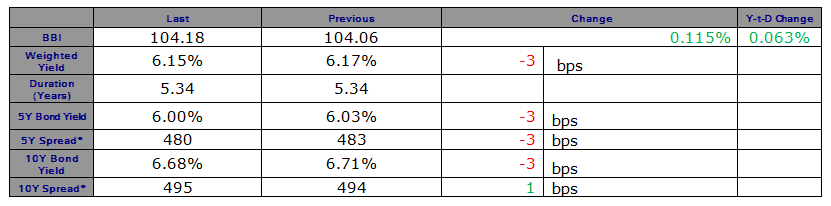

Demand for Lebanese Eurobonds improved on Wednesday as revealed by the BLOM Bond Index (BBI) which increased by 0.12% to register 104.18 points.

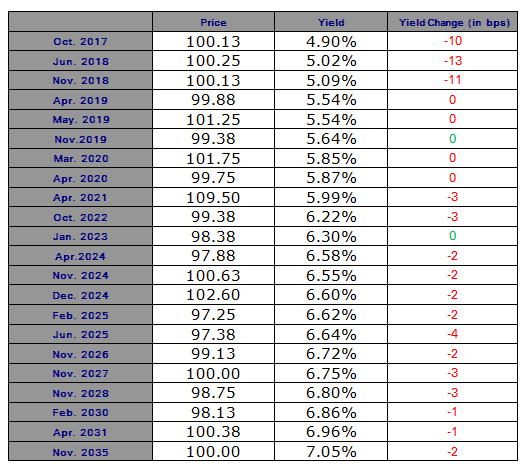

The yields on the Lebanese Eurobonds maturing in 5 and 10 years fell each by 3 basis points (bps) to 6.00% and 6.68%, respectively.

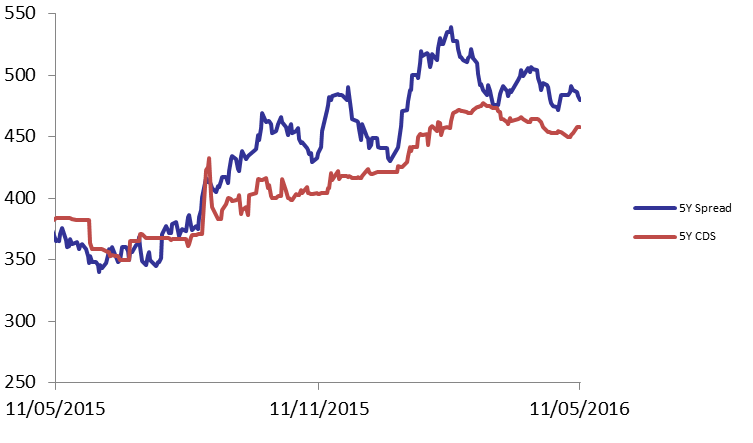

As demand for U.S treasuries maturing in 5 years remained stable, the spread between the yield on the 5 Year Lebanese Eurobonds and the yield on their US comparable narrowed by 3 points to 480 bps.

The bid-ask range for Lebanon’s 5Y Credit Default Swaps (CDS) remained unchanged at their previous level of 448-468 bps.