Slight Improvement for Medium-Term Lebanese Eurobonds on Thursday

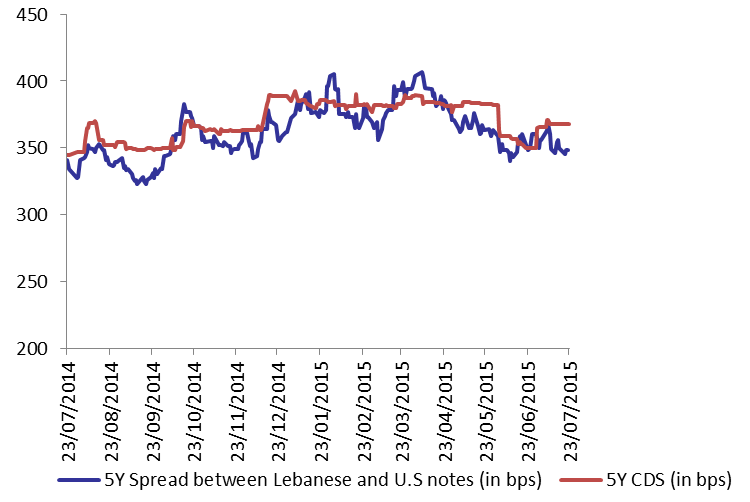

Demand for medium-term Lebanese Eurobonds barely improved on Thursday as the BLOM Bond Index (BBI) ticked up by 0.02% to 107.24. The yield on the 10Y Lebanese Eurobonds remained at 6.06% while that of the 5Y slipped by 1 basis point (bp) to 5.16%. The spread between the yield on the 5Y Lebanese Eurobonds and its US comparable broadened by 3 bps to 351 as the demand for medium-term US notes progressed at a faster pace than that of the Lebanese market. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) steadied at 355-380 bps for the 10th consecutive session.

| 0 | Last | Previous | Change | |

| BBI | 107.24 | 107.22 | 0.02% | |

| Weighted Yield | 5.45% | 5.46% | -1 | bps |

| Duration (Years) | 5.10 | 5.10 | 0 | years |

| 5Y Bond Yield | 5.16% | 5.17% | -1 | bps |

| 5Y Spread* | 351 | 348 | 3 | bps |

| 10Y Bond Yield | 6.06% | 6.06% | 0 | bps |

| 10Y Spread* | 378 | 373 | 5 | bps |

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.85 | 4.05% | 0 |

| Mar. 2017 | 107.45 | 4.29% | 0 |

| Oct. 2017 | 101.12 | 4.46% | 0 |

| Jun. 2018 | 101.46 | 4.60% | 0 |

| Nov. 2018 | 101.23 | 4.74% | 0 |

| Apr. 2019 | 101.75 | 4.98% | 0 |

| Mar. 2020 | 104.38 | 5.29% | 0 |

| Apr. 2020 | 101.88 | 5.34% | 0 |

| Apr. 2021 | 113.25 | 5.51% | 0 |

| Oct. 2022 | 102 | 5.75% | 0 |

| Jan. 2023 | 101 | 5.83% | 0 |

| Dec. 2024 | 106.88 | 6.03% | 0 |

| Feb. 2025 | 101 | 6.06% | 0 |

| Nov. 2026 | 102.63 | 6.27% | 0 |

| Nov. 2027 | 103.63 | 6.32% | 0 |

| Feb. 2030 | 101.63 | 6.47% | 0 |