Slight Progress of Lebanese Eurobonds’ Market on Monday

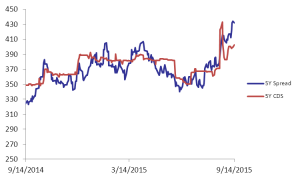

Slight improvement in demand for short and medium term Lebanese Eurobonds on Monday caused the BLOM Bond Index (BBI) to increase by 0.02% to 105.77 points, narrowing its year-to-date loss to 1.58%. Yield on the 10Y Lebanese Eurobonds steadied at 6.31% for the 3rd session running while that of the 5Y dropped by 3 basis points (bps) to 5.83%. Similarly, demand for medium-term US notes progressed at a slower pace than its Lebanese counterpart. This caused the 5Y spread between both notes to narrow by 2 bps to 432 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they slightly widened from their pervious quotes of 387-412 bps to 390-415 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.772 | 105.750 | 0.021% | -1.58% | |

| Weighted Yield | 5.74% | 5.74% | 0 | bps | |

| Duration (Years) | 4.99 | 5.00 | |||

| 5Y Bond Yield | 5.83% | 5.86% | -3 | bps | |

| 5Y Spread* | 432 | 434 | -2 | bps | |

| 10Y Bond Yield | 6.31% | 6.31% | 0 | bps | |

| 10Y Spread* | 413 | 411 | 2 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.54 | 4.25% | 5 |

| Mar. 2017 | 106.25 | 4.68% | -2 |

| Oct. 2017 | 100.38 | 4.80% | -7 |

| Jun. 2018 | 100.5 | 4.95% | 0 |

| Nov. 2018 | 100.25 | 5.06% | 0 |

| Apr. 2019 | 100.75 | 5.27% | 0 |

| May. 2019 | 102.25 | 5.32% | 0 |

| Nov.2019 | 100 | 5.45% | 0 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.5 | 5.67% | 0 |

| Apr. 2021 | 110.88 | 5.93% | -3 |

| Oct. 2022 | 100.75 | 5.97% | 0 |

| Jan. 2023 | 99.85 | 6.02% | 0 |

| Dec. 2024 | 105.6 | 6.19% | 0 |

| Feb. 2025 | 99.75 | 6.23% | 0 |

| Jun. 2025 | 99.75 | 6.28% | 0 |

| Nov. 2026 | 100.75 | 6.50% | 0 |

| Nov. 2027 | 101.5 | 6.57% | 0 |

| Feb. 2030 | 99.75 | 6.68% | 0 |