The Lebanese Bourse Experienced a Negative Performance Today

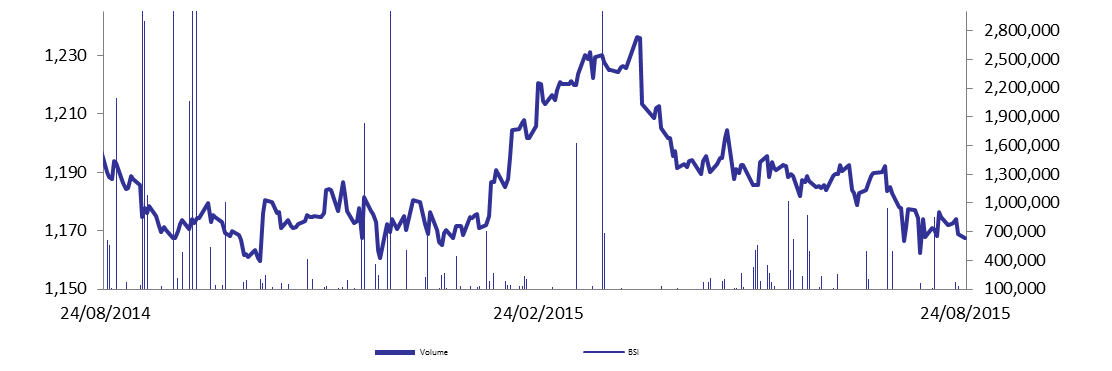

The negative performance of real estate sector triggered down the Lebanese Bourse during the 1st session of the week. The BLOM Stock Index (BSI) fell by 0.13% to 1,167.39 points, widening its year-to-date loss to 0.24%. In the real estate sector, Solidere A and B shares were marked by a 1.83% and 0.09% drop to settle at the same quote of $10.75, respectively. In the banking sector, Byblos preferred shares 2008 and BLC preferred shares class “A” lost 0.40% and 0.59% to settle at $100.60 and $100.50, respectively. In contrast, Bank of Beirut preferred shares class “E”, Bank Audi GDR shares, and BLOM Bank listed shares gained 1.18%, 0.17% and 0.53% to close the session at respective quotes of $25.80, $6.00 and $9.55. Meanwhile, BLOM GDR shares, Bank Audi listed shares and Bank of Beirut preferred shares class “J” traded with no change in price.

| Traded Stocks | Last | Previous | Change | Volume | Vwap |

| Solidere (A) | $10.75 | $10.95 | -1.83% | 25,578 | $10.76 |

| Solidere (B) | $10.75 | $10.76 | -0.09% | 2,361 | $10.73 |

| BLOM GDR | $10.00 | $10.00 | – | 15,500 | $10.00 |

| BLOM Listed | $9.55 | $9.50 | 0.53% | 50,000 | $9.55 |

| Audi GDR | $6.00 | $5.99 | 0.17% | 80,850 | $6.00 |

| Audi Listed | $6.00 | $6.00 | – | 9,110 | $6.00 |

| Byblos Pref 08 | $100.60 | $101.00 | -0.40% | 250 | $100.60 |

| BLC Pref A | $100.50 | $101.10 | -0.59% | 300 | $100.50 |

| BoB Pref E | $25.80 | $25.50 | 1.18% | 8,000 | $25.80 |

| BoB Pref J | $ 25.75 | $ 25.75 | – | 8,127 | $25.75 |

| 0 | Last | Previous | % Change | Y-t-D % Change |

| BSI | 1,167.39 | 1,168.91 | -0.13% | -0.24% |

| High | 1,169.87 | 1,170.64 | ||

| Low | 1,166.68 | 1,167.82 | ||

| Vol | 200,076 | 133,991 | 49.32% | |

| Val | $1,943,626 | $1,209,571 | 60.69% |

| 0 | Last | Previous | Change |

| BPSI | 105.16 | 105.18 | -0.02% |

| Vol | 16,677 | 81,933 | -79.65% |

| Val | $470,969 | $950,575 | -50.45% |