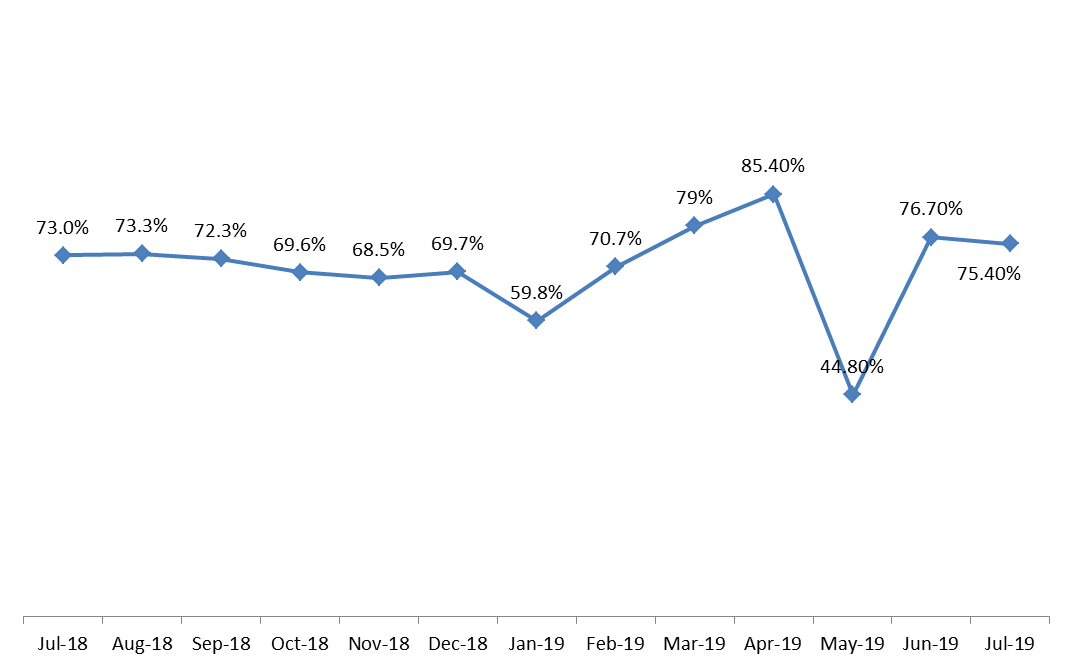

According to Ernst & Young Middle East hotel benchmark survey, the occupancy rate in Lebanon’s 4- and 5-star hotels reached a 4-year high of 70.20% by July 2019, compared to 61% during the same period last year. The improvement is largely attributed to the substantial improvement recorded in the number of tourists during summer season

In details, Beirut’s higher hotel occupancy rate was accompanied by annual upticks in Beirut’s average room rate and rooms yield, which climbed from $185 and $113 by July 2018 to $203 and $143 by July 2019, respectively. In fact, the upticks across the board in Beirut can be attributed to the number of tourist arrivals to Lebanon which added 8.1% year-on-year (y-o-y) to hit 1,206,052 tourists by July 2019. Yet, it is interesting to note that by July 2019, the tourism canvas began to slowly shift such that number of European tourists surpassed that of Arabs. In details, the number of European tourists gained thrust (comprising 36.3% of total arrivals to Lebanon) to reach 437,797 by July 2019, up by 9.6% y-o-y. These were followed by tourists from the Arab countries (30.8% of total) to stand at 371,467, adding 20.3% y-o-y. Noting that Arab tourists are the largest spenders, it is worthy to highlight the surge in the number of tourists from Saudi Arabia. These last rose by 86.3% by July 2019 with the KSA lifting the travel ban in Feb 2019.

During the month of July, Makkah and Madinah, the KSA’s holy cities, also recorded upticks across the board, given the high season for religious pilgrimage in Makkah and Madinah. In August 2019, more than two million Hajj pilgrims are expected to descend upon the Holy City of Makkah. As such, the occupancy rate in each of Makkah and Madinah rose from 54.9% and 57.9% to 57.1% and 76.7%, respectively. In turn, the average room rate and rooms yield in Makkah climbed from $97 and $53 to $121 and $69 by July 2019 while those in Madinah increased from $119 and $69 to $149 and $114 over the same period.

As for Kuwait, its occupancy rate slid by an annual 1.5 percentage points (pp) to stand at 48.5% by July 2019. The drop can be largely attributed to the market’s heavy reliance on business travellers, and the limited number of conferences and events held during the month. Nonetheless, Kuwait’s long-term tourism growth strategies such as the Vision 2035 and associated mega projects are expected to diversify source markets and benefit the hotel industry in the long-term. In details, the average room rate and rooms yield dropped from $156 and $78 to $147 and $71, respectively by July 2019.

Meanwhile, Dubai witnessed a drop across all its KPIs. The city’s hotel occupancy rate decreased by 1.7 p.p. to 59.4% by July 2019, owing it to “Softer economic conditions together with the entry of new inventory in the market”. As such, average room rate and rooms yield declined by a yearly 11% and 13.4%, to $121 and $72, respectively over the same period.

Monthly Occupancy Rates in Beirut’s 4- and 5-star Hotels

Source: E&Y Middle East Hotel Benchmark Survey