5Y and 10Y Lebanese Eurobonds Steadied on Monday

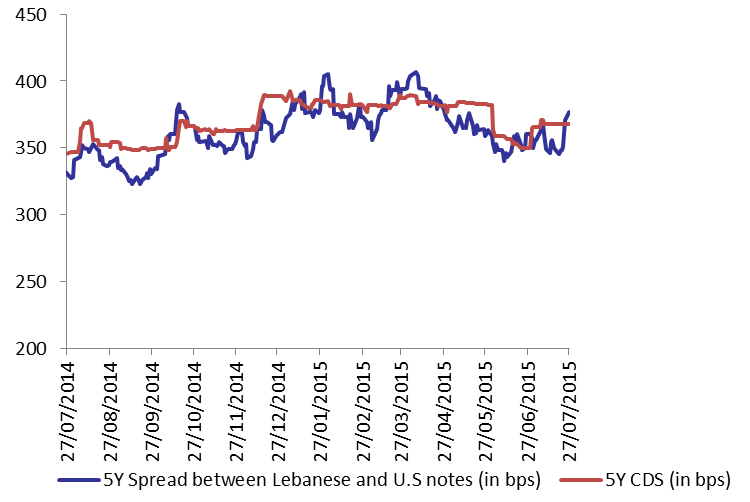

Demand for Lebanese Eurobonds was unchanged on Monday as the BLOM Bond Index (BBI) steadied at 107.08. The yields on both the 5Y and 10Y Lebanese Eurobonds remained at 5.35% and 6.21%, respectively. The spread between the yield on the 5Y Lebanese Eurobonds and its US comparable broadened by 6 bps to 377 as the demand for medium-term US notes improved. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) stagnated at their previous range of 356-379 bps.

| Last | Previous | Change | Y-t-D %Change | ||

| BBI | 107.08 | 107.08 | 0.00% | -0.36% | |

| Weighted Yield | 5.49% | 5.49% | 4 | bps | |

| Duration (Years) | 5.10 | 5.09 | |||

| 5Y Bond Yield | 5.35% | 5.35% | 0 | bps | |

| 5Y Spread* | 377 | 371 | 6 | bps | |

| 10Y Bond Yield | 6.21% | 6.21% | 0 | bps | |

| 10Y Spread* | 398 | 394 | 4 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.75 | 4.13% | 0 |

| Mar. 2017 | 107.4 | 4.31% | 0 |

| Oct. 2017 | 100.8 | 4.61% | 0 |

| Jun. 2018 | 101.46 | 4.60% | 0 |

| Nov. 2018 | 100.88 | 4.86% | 0 |

| Apr. 2019 | 101.75 | 4.98% | 0 |

| Mar. 2020 | 104.25 | 5.32% | 0 |

| Apr. 2020 | 101.75 | 5.37% | 0 |

| Apr. 2021 | 113 | 5.56% | 0 |

| Oct. 2022 | 101.88 | 5.78% | 0 |

| Jan. 2023 | 100.75 | 5.87% | 0 |

| Dec. 2024 | 106.75 | 6.04% | 0 |

| Feb. 2025 | 100.75 | 6.09% | 0 |

| Nov. 2026 | 102.5 | 6.29% | 0 |

| Nov. 2027 | 103.5 | 6.34% | 0 |

| Feb. 2030 | 101.5 | 6.49% | 0 |