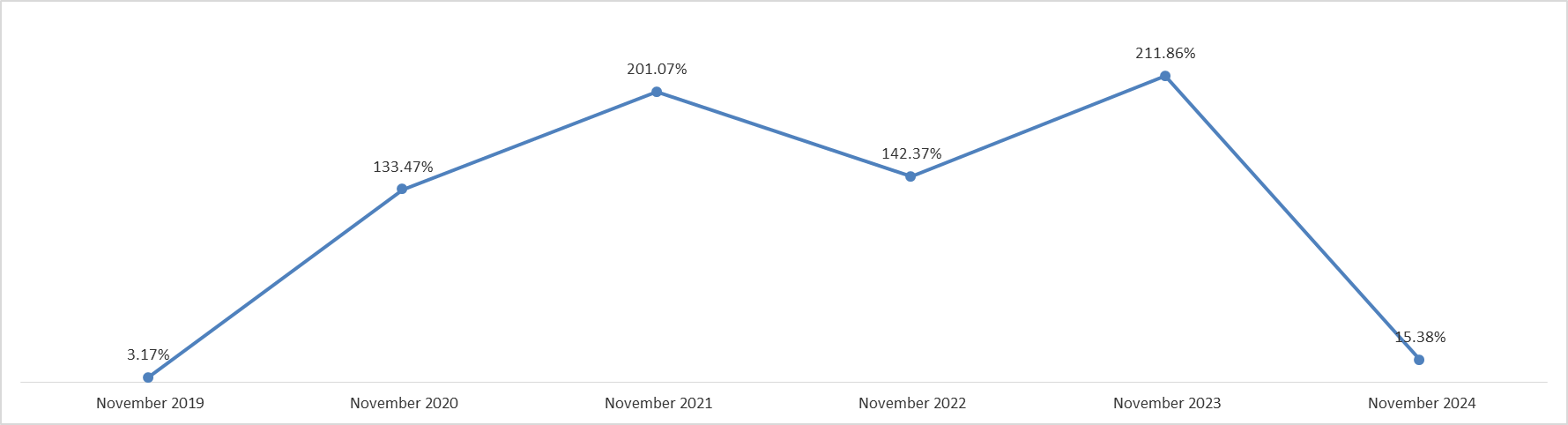

Lebanon’s annual inflation rate fell to 15.38% in November 2024, from 15.68% in October 2024, recording its lowest level since March 2020, according to the Central Administration of Statistics (CAS). The decrease resulted from the increase of dollarization rates by businesses and to the stability of the exchange rate especially since August 2023. Meanwhile, the continued escalating political and military tensions in the Middle East and its effect on Red Sea sea-shipping traffic threatens to disrupt supply chains, which will increase shipping costs, and consequently lead to an increase in inflation. In addition, the escalation of the war between Lebanon and Israel that ended on November 27th, 2024 resulted in an increase in prices of several expenditure divisions such as “New Rent”, “Food & Non-alcoholic Beverages”.

Source: CAS, BLOMINVEST

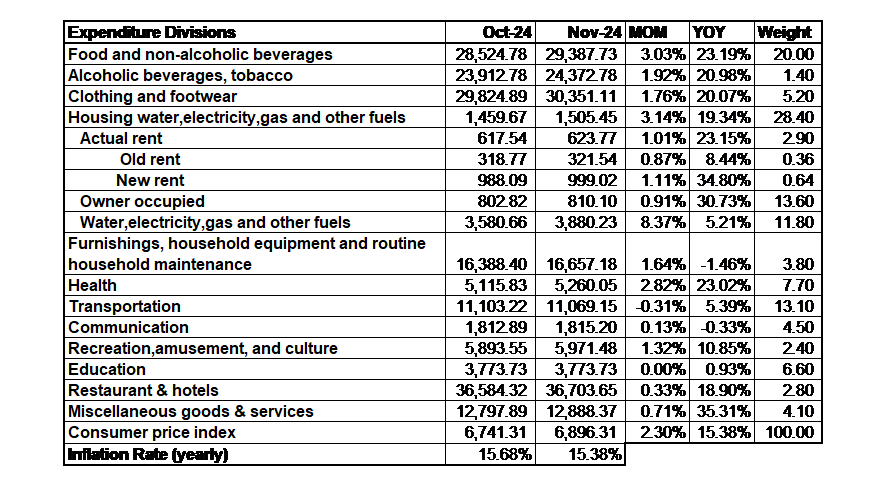

In details, it is worthwhile to note that Food & Non-alcoholic Beverages (20% of CPI) increased by 23.19% YOY, Health (7.7% of CPI) surged by 23.02% YOY, Owner Occupied (13.6% of CPI) soared by 30.73% YOY and Miscellaneous Goods & Services (4.1% of CPI) rose by 35.31% YOY during the same period.

The table below shows that “New Rent” increased YOY by 34.8% and this is attributed to the escalation of the war in Lebanon that forced around 25% of Lebanese population who are living in South Lebanon, Bekaa, and Nabatieh governorates in addition to the Southern Suburbs of Beirut to move to other areas. Thus, the demand exceeded the supply of apartments for rent which lead to an increase in rent expenditures.

On a monthly basis, Consumer Price Index (Inflation) increased between October 2024 and November 2024 by 2.3%.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.