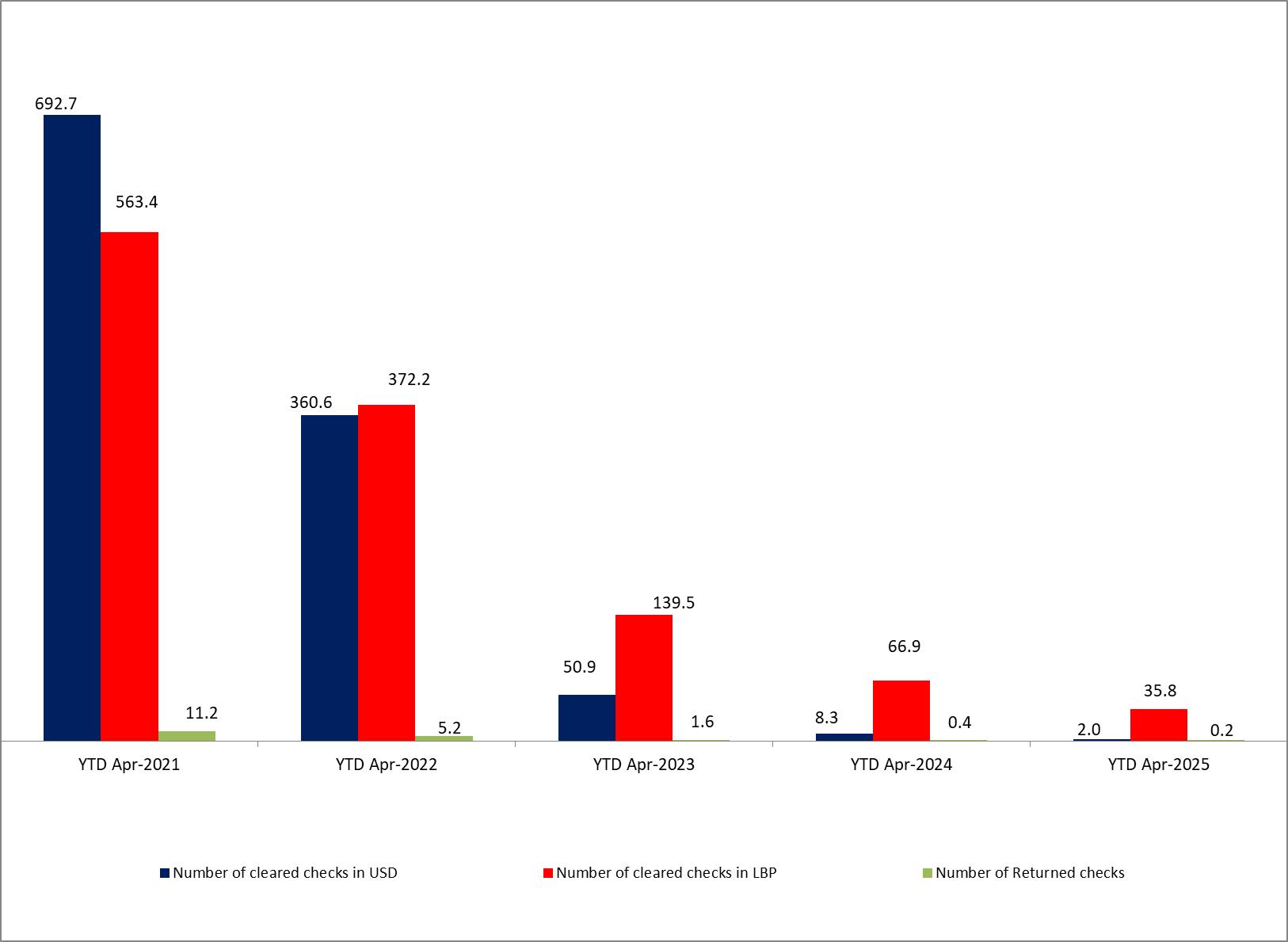

According to the data published by the Association of Lebanese Banks’ (ABL), the total number of cleared checks in the Lebanese financial system decreased remarkably by 49.84% year over year (YoY) to 37,764 checks by April 2025. Similarly, the cumulative value of cleared checks in local currency decreased by 17.07% YoY to LBP 19,592B by April 2025. Likewise, the cumulative value of cleared checks in foreign currency dropped by 48.88% YoY to reach $297M by April 2025.

Moreover, the volumes of cleared checks in Lebanese Pounds and foreign currencies witnessed substantial yearly drop of 46.53% and 76.40% respectively to settle at 35,794 and 1,970 checks, in April 2025. Accordingly, the dollarization rate of checks in terms of volume fell from 11.09% in April 2024 to 5.22% in April 2025.

Notably, the number of returned checks dropped substantially by 47.18% YOY to stand at 225 checks in April 2025. Moreover, the value of returned checks in local currency decreased by 37.21% YOY to record LBP 108B, however, the value of returned checks in foreign currency increased significantly by 227.32% YOY to record $67M in April 2025.

Banque du Liban (BDL) recently issued Circular 165, which permits depositors to make payments by check starting June 1st, 2023, as long as their accounts are in either fresh US dollars or Lebanese lira. To support this initiative, BDL has introduced a new clearing system, distinct from the one dedicated to pre-crisis deposits. This circular serves a dual purpose: it encourages customers to open new accounts in both Lebanese pounds and US dollars, while also aiming to decrease the country’s dependence on cash and stimulate economic recovery. As such, in April 2025, the cumulative number of checks issued from fresh accounts reached 20,398, of which 15,449 checks are in USD currency amounting $213.08M and 4,949 checks are in LBP currency amounting LBP 9,508B. On a monthly basis, the number of cleared checks in April 2025 was 5,648 checks.

Cleared Checks by April 2025 (in 000s)

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.