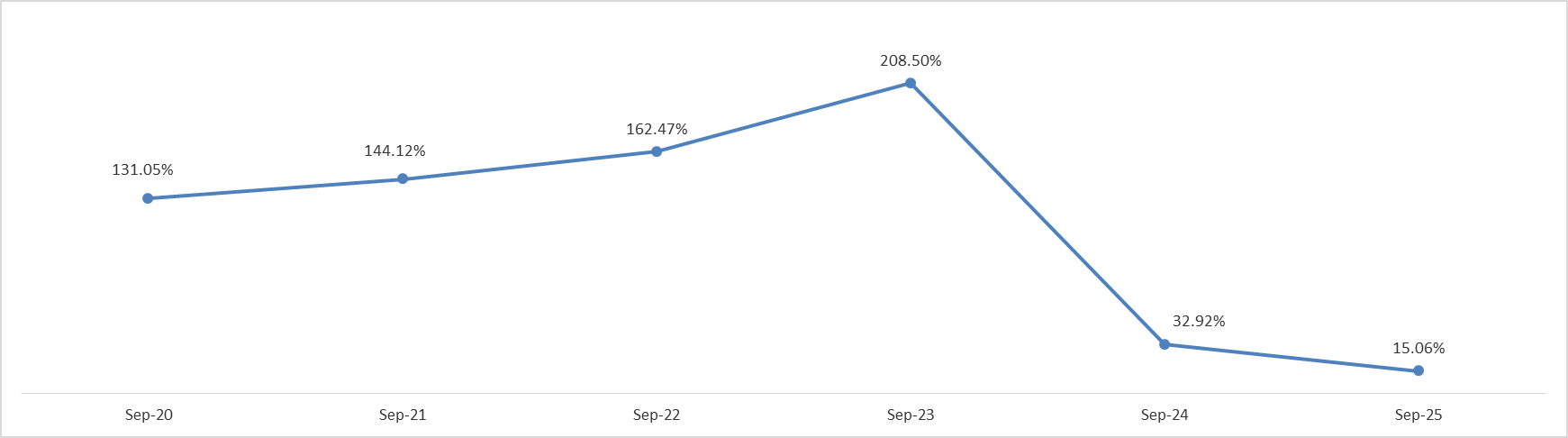

Lebanon’s annual inflation rate decreased to 15.06% in September 2025, from 14.17% in August 2025, according to the Central Administration of Statistics (CAS). The slight moderation reflected a relatively stable exchange rate, tighter monetary control by the Central Bank, and a seasonal slowdown in consumer demand following the summer peak. Energy and fuel prices also remained broadly unchanged amid steady global oil markets and improved power supply from Electricité du Liban, easing household electricity costs. Moreover, expectations surrounding the IMF mission’s late-September visit and the government’s cautious fiscal stance helped anchor price pressures, while stable food import costs further supported disinflation across key CPI components.

Source: CAS, BLOMINVEST

Source: CAS, BLOMINVEST

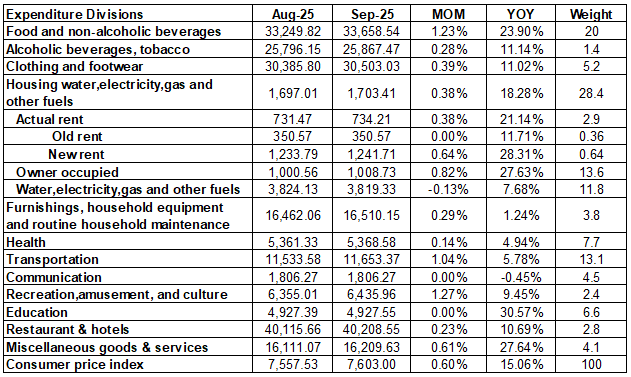

In details, it is worthwhile to note that Education (6.6% of CPI) increased by 30.57%% YOY, New rent (0.64% of CPI) soared by 28.31% YOY, and Miscellaneous goods & services (4.1% of CPI) rose by 27.64% YOY during the same period.

The highest yearly increase was recorded in the “Education” component, which rose by 30.57% in September 2025. This sharp uptick was mainly driven by the start of the new academic year, during which private schools and universities significantly raised tuition fees to offset higher operating costs, salary adjustments, and the depreciation of the Lebanese pound over the past year. Additionally, the shift toward dollarization payments in many private institutions and increased costs of educational materials and transportation further amplified the annual rise in education expenses.

On a monthly basis, Consumer Price Index (Inflation) increased between August 2025 and September 2025 by 0.60%.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.