The recent publication of CAS’s National Account for the years 2022 and 2023 can now enable us to study exports and domestic performance in more details and rigor. This is interesting because discussions about trade during the Lebanese crisis have focused on imports and how they have remained solid throughout, despite the severe drop in Lebanese income and exchange rates. What makes the alternate focus on exports more interesting is that, unlike imports, exports is part of GDP and its performance reflects directly on the performance of GDP. As important, since GDP is by definition the value of all goods and services produced domestically, then exports constitutes the part of these domestic goods that goes abroad and GDP minus exports constitute the part that stays home.

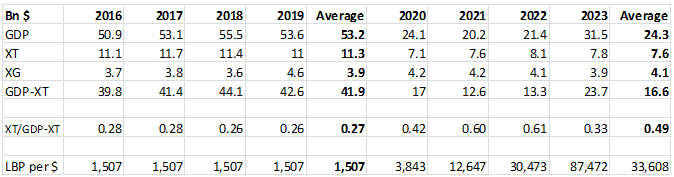

So how did these two parts perform: exports and GDP minus exports? The table above depicts the behavior of these variables during the pre-crisis years of 2016 to 2019 and during the crisis years of 2020 t0 2023. A few crucial observations can be detected from the table:

1) Total exports of goods and services XT averaged $11.3 billion prior to the crisis but fell to $7.6 billion during the crisis. More interesting is that the fall was due to the decline in exports of services from an average of $7.5 billion to $3.5 billion (not shown).

2) However, exports of goods XG actually improved, as average exports of goods increased from $3.9 billion to $4.1 billion. This result, though surprising, is actually expected as weaker exchange rates would have stimulated exports of goods, in addition to the fact that exporters would have been coaxed to sell more abroad given the weakness of the domestic market.

3) As to the part of GDP that was left for the local or home market, GDP minus exports of goods and services, GDP – XT, it fell from $41.9 billion to $16.6 billion. Another way of seeing this is that XT/(GDP – XT), the ratio of exports of goods and services to GDP minus exports of goods and services, increased from 0.27 to 0.49.

4) The fact that GDP minus exports of goods and services fell substantially (from $41.9 billion to $16.6 billion) is quite interesting. It indicates that less exportables were left to the home market and, as important, that less non-tradeables were obtained in GDP. In addition, the decline in non-tradeables must have been a product of the decline in both volume and prices in terms of USD[1].

That imports of goods have remained solid during the crisis, as is well known, was mostly due to inelastic price and income elasticities (perhaps also due to the active smuggling or transfer of these imports to neighboring countries). But the fact that exports of goods have been actually stronger during the crisis is something to be very happy about, as it reflects the durability and flexibility of this sector in spite of the harsh crisis conditions. And on a preliminary basis, it could bode well to the ability of the external sector to outdo itself in any future restructuring of the economy. But the flip side of this adjustment or transformation is the relative deceleration of the non-tradeables economy.

[1] Although in terms of purchasing power parity prices, the value of non-tradeables would have been higher.

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.