Demand Fell for Lebanese Eurobonds on Wednesday

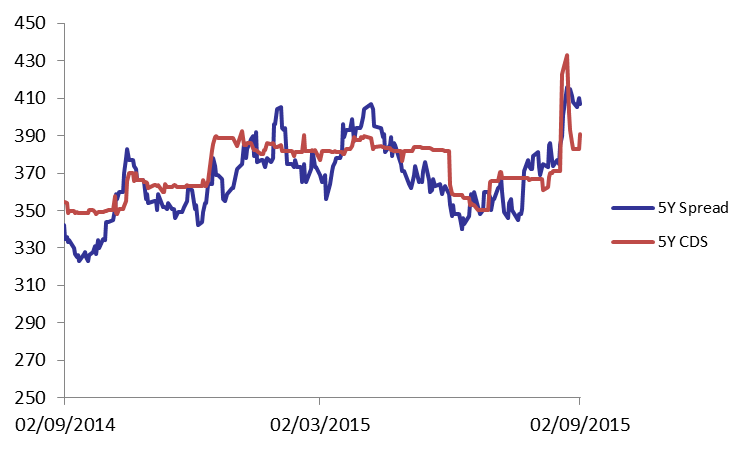

Demand for Lebanese Eurobonds was weak on Wednesday as the BLOM Bond Index (BBI) fell by 0.16% to 105.72 points, with a year-to-date loss of 1.63%. Yields on the 5Y and 10Y Lebanese Eurobonds increased by 2 basis points (bps) each to 5.61% and 6.45%, respectively. The 5Y spread between Lebanese Eurobonds and their US counterpart contracted by 1 bp, given that demand for U.S. medium term notes regressed at a faster pace that that of the medium term Lebanese notes. As for the Lebanese 5Y Credit Default Swaps (CDS), they broadened from 368-397 bps to 378-403 bps.

| Last | Previous | Change | Y-t-D Change | |||||

| BBI | 105.723 | 105.892 | -0.16% | -1.63% | ||||

| Weighted Yield | 5.74% | 5.71% | 3 | bps | ||||

| Duration (Years) | 5.02 | 5.02 | ||||||

| 5Y Bond Yield | 5.61% | 5.59% | 2 | bps | ||||

| 5Y Spread* | 409 | 410 | -1 | bps | ||||

| 10Y Bond Yield | 6.45% | 6.43% | 2 | bps | ||||

| 10Y Spread* | 425 | 426 | -1 | bps | ||||

*Between Lebanese and U.S notes

|