Demand for Lebanese Eurobonds Stabilized During the First Session of the Week

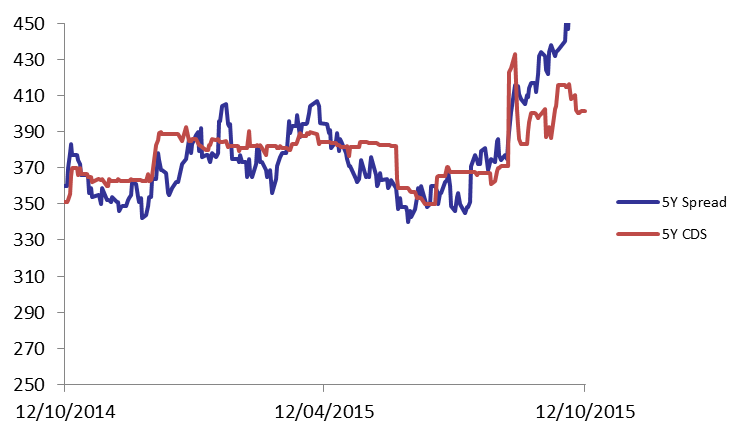

Disparate in demand for Lebanese Eurobonds on Monday caused the BLOM Bond Index (BBI) to steady at 104.90 points, registering a year-to-date loss of 2.39%. Yield on the 10Y Lebanese Eurobonds steadied at 6.48% for the 8th consecutive session, while that of the 5Y increased by 2 basis points (bps) to 5.96%. In the US, demand for medium-term maturities steadied, noting that markets were all closed on Columbus Day, celebrated on Monday October 12, 2015. In turn, 5Y spread between the Lebanese Eurobonds and their U.S comparable broadened by 2 basis points (bps) to 455 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they remained at their previous quotes of 390-413 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.899 | 104.899 | 0.000% | -2.39% | |

| Weighted Yield | 5.93% | 5.93% | 0 | bps | |

| Duration (Years) | 4.94 | 4.93 | |||

| 5Y Bond Yield | 5.96% | 5.94% | 2 | bps | |

| 5Y Spread* | 455 | 453 | 2 | bps | |

| 10Y Bond Yield | 6.48% | 6.48% | 0 | bps | |

| 10Y Spread* | 436 | 436 | 0 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.4 | 4.36% | 0 |

| Mar. 2017 | 105.5 | 4.99% | -2 |

| Oct. 2017 | 99.88 | 5.06% | 6 |

| Jun. 2018 | 99.75 | 5.25% | 0 |

| Nov. 2018 | 99.5 | 5.33% | 0 |

| Apr. 2019 | 100 | 5.50% | 0 |

| May. 2019 | 101.25 | 5.61% | 0 |

| Nov.2019 | 99 | 5.72% | 0 |

| Mar. 2020 | 102.13 | 5.82% | 0 |

| Apr. 2020 | 99.75 | 5.86% | 0 |

| Apr. 2021 | 110 | 6.08% | -4 |

| Oct. 2022 | 99.75 | 6.14% | 2 |

| Jan. 2023 | 98.88 | 6.19% | 0 |

| Dec. 2024 | 104.25 | 6.38% | 0 |

| Feb. 2025 | 98.5 | 6.41% | 0 |

| Jun. 2025 | 98.5 | 6.46% | 0 |

| Nov. 2026 | 100 | 6.60% | 0 |

| Nov. 2027 | 100.75 | 6.66% | 0 |

| Feb. 2030 | 99 | 6.76% | 0 |