Demand for Long Term Lebanese Eurobonds Weakened on Tuesday

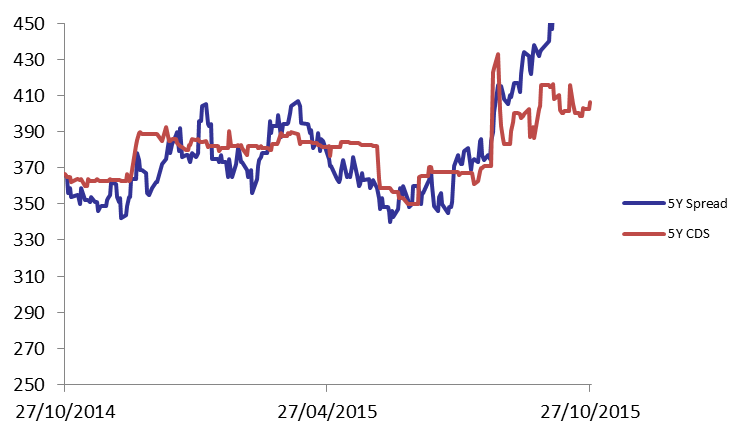

Following two sessions of relatively stable demand on the Lebanese Eurobonds market, appetite for long term Lebanese notes weakened on Tuesday. This caused the BLOM Bond Index (BBI) to fall by 0.05% to 104.97 points, broadening its year-to-date loss to 2.32%. While yield on the 10Y Lebanese Eurobonds increased by 2 basis points (bps) to 6.47%, the 5Y yield dropped by 1 bp to 5.95%. In the US, demand for medium term maturities improved faster than that of their Lebanese counterpart, causing the 5Y spread between the both notes to widen by 2 basis points (bps) to 457 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they broadened from their previous quotes of 391-414 bps to 395-418 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.972 | 105.029 | -0.054% | -2.32% | |

| Weighted Yield | 5.91% | 5.90% | 1 | bps | |

| Duration (Years) | 4.91 | 4.91 | |||

| 5Y Bond Yield | 5.95% | 5.96% | -1 | bps | |

| 5Y Spread* | 457 | 455 | 2 | bps | |

| 10Y Bond Yield | 6.47% | 6.45% | 2 | bps | |

| 10Y Spread* | 442 | 438 | 4 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.39 | 4.35% | 0 |

| Mar. 2017 | 105.5 | 4.87% | -1 |

| Oct. 2017 | 99.75 | 5.13% | 0 |

| Jun. 2018 | 99.75 | 5.25% | 0 |

| Nov. 2018 | 99.5 | 5.33% | 0 |

| Apr. 2019 | 100 | 5.50% | 0 |

| May. 2019 | 101.25 | 5.61% | 0 |

| Nov.2019 | 99 | 5.73% | 0 |

| Mar. 2020 | 102.25 | 5.78% | 0 |

| Apr. 2020 | 100 | 5.80% | -6 |

| Apr. 2021 | 110 | 6.07% | 5 |

| Oct. 2022 | 99.75 | 6.14% | 0 |

| Jan. 2023 | 98.88 | 6.19% | 2 |

| Dec. 2024 | 104.5 | 6.34% | 0 |

| Feb. 2025 | 98.75 | 6.38% | 2 |

| Jun. 2025 | 98.75 | 6.42% | 2 |

| Nov. 2026 | 100.13 | 6.58% | 3 |

| Nov. 2027 | 101.13 | 6.61% | 0 |

| Feb. 2030 | 99 | 6.76% | 1 |