Demand Weakened for Lebanese Eurobonds on Wednesday

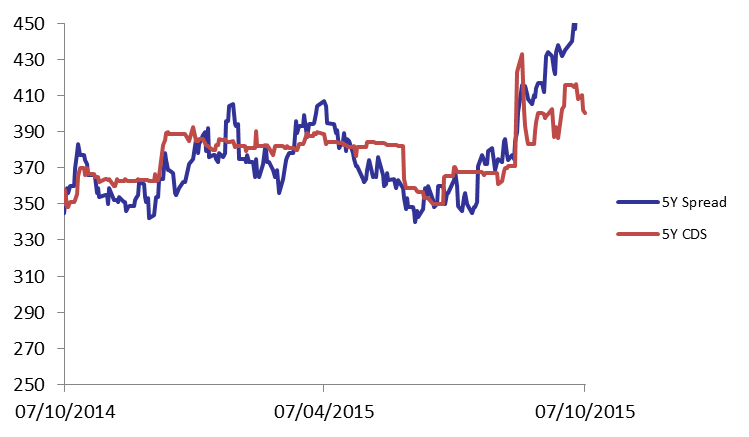

Despite a slightly improving activity on the Lebanese Eurobonds market, demand for sovereign debt denominated in foreign currency dwindled on Wednesday. Accordingly, BLOM Bond Index (BBI), declined by 0.07% to 104.77 points, broadening its year-to-date loss to 2.51%. Yield on the 10Y Lebanese Eurobonds steadied 6.48% for the 5th session running, while that of the 5Y increased by 3 basis points (bps) to 6.00%. The 5Y spread between the Lebanese Eurobonds and their U.S comparable revealed no change as it remained at 463 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they narrowed from their previous quote 391-413 bps to 389-412 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.768 | 104.842 | -0.071% | -2.51% | |

| Weighted Yield | 5.96% | 5.96% | 0 | bps | |

| Duration (Years) | 4.93 | 5.94 | |||

| 5Y Bond Yield | 6.00% | 5.97% | 3 | bps | |

| 5Y Spread* | 463 | 463 | 0 | bps | |

| 10Y Bond Yield | 6.48% | 6.48% | 0 | bps | |

| 10Y Spread* | 440 | 443 | -3 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.41 | 4.35% | 0 |

| Mar. 2017 | 105.38 | 5.11% | -1 |

| Oct. 2017 | 99.75 | 5.13% | 0 |

| Jun. 2018 | 99.5 | 5.35% | 0 |

| Nov. 2018 | 99.25 | 5.41% | 0 |

| Apr. 2019 | 100 | 5.50% | 0 |

| May. 2019 | 101 | 5.69% | 4 |

| Nov.2019 | 98.88 | 5.76% | -7 |

| Mar. 2020 | 102.13 | 5.82% | -3 |

| Apr. 2020 | 99.75 | 5.86% | 0 |

| Apr. 2021 | 109.75 | 6.14% | 0 |

| Oct. 2022 | 99.25 | 6.23% | 9 |

| Jan. 2023 | 99 | 6.17% | -2 |

| Dec. 2024 | 104.25 | 6.38% | 2 |

| Feb. 2025 | 98.5 | 6.41% | 2 |

| Jun. 2025 | 98.5 | 6.46% | 2 |

| Nov. 2026 | 100 | 6.60% | 3 |

| Nov. 2027 | 100.75 | 6.66% | 3 |

| Feb. 2030 | 98.75 | 6.79% | 3 |