Higher Appetite Witnessed on the Lebanese Eurobonds Market

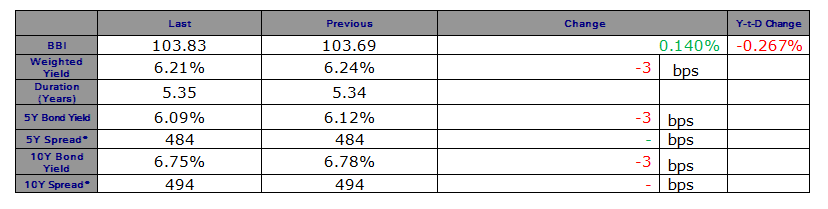

Demand for most of the Lebanese Eurobonds improved on Tuesday as reflected by the BLOM Bond Index (BBI) which registered a reading of 103.83 points, rising by 0.14% from its previous level.

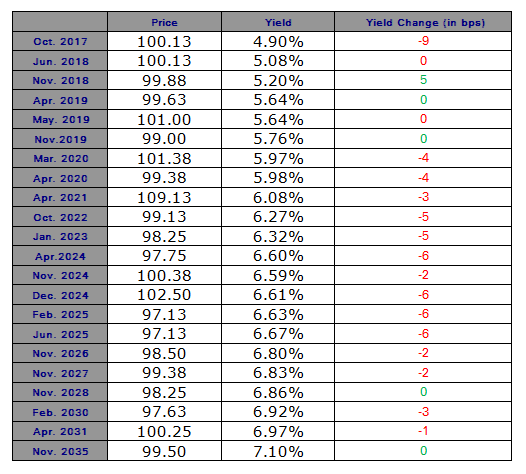

The yields on the Lebanese Eurobonds maturing in 5 and 10 years fell each by 3 basis points (bps) to 6.09% and 6.75%, respectively.

As demand for U.S treasuries improved at the same pace, the spread between the yield on the 5 Year Lebanese Eurobonds and the yield on their US comparable remained unchanged at 484 basis points.

The bid-ask range for Lebanon’s 5Y Credit Default Swaps (CDS) slightly widened from its previous level of 440-460 bps to 441-461 bps.