Higher Demand for Lebanese Eurobonds across Maturities

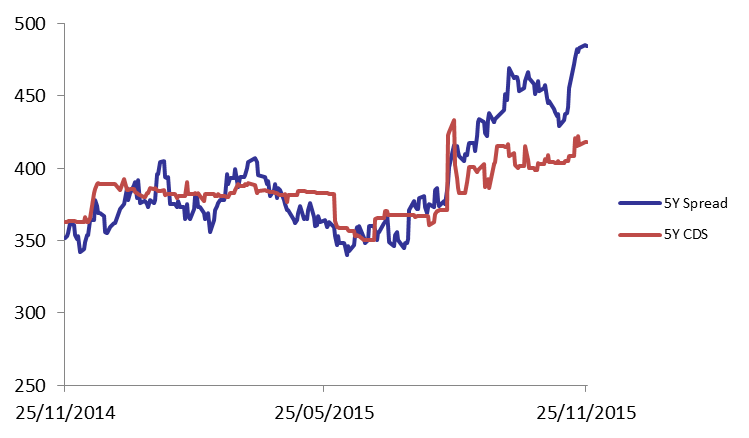

The BLOM Bond Index (BBI) recouped some losses and gained 0.3% to 102.72 points.The yields on the Lebanese Eurobonds maturing in 5 Years and 10 Years slid from 6.51% and 6.90% to 6.50% and 6.87%, respectively. The 5Y yield spread between the Lebanese Eurobonds and their US comparable narrowed from a previous 485 bps to 484 bps while Lebanon’s 5Y Credit Default Swaps went from 403-433 bps to 408-428 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 102.724 | 102.459 | 0.259% | -4.42% | |

| Weighted Yield | 6.37% | 6.44% | -8 | bps | |

| Duration (Years) | 5.11 | 5.11 | |||

| 5Y Bond Yield | 6.50% | 6.51% | -1 | bps | |

| 5Y Spread* | 484 | 485 | -1 | bps | |

| 10Y Bond Yield | 6.87% | 6.90% | -3 | bps | |

| 10Y Spread* | 464 | 466 | -2 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100 | 4.75% | 0 |

| Mar. 2017 | 105 | 5.03% | -39 |

| Oct. 2017 | 99.38 | 5.35% | -14 |

| Jun. 2018 | 99 | 5.58% | 0 |

| Nov. 2018 | 99 | 5.52% | -9 |

| Apr. 2019 | 98.5 | 5.99% | 0 |

| May. 2019 | 100 | 6.00% | -24 |

| Nov.2019 | 97.5 | 6.16% | -14 |

| Mar. 2020 | 100 | 6.37% | 0 |

| Apr. 2020 | 98 | 6.33% | -7 |

| Apr. 2021 | 107.5 | 6.57% | -3 |

| Oct. 2022 | 97.25 | 6.60% | -5 |

| Jan. 2023 | 96.5 | 6.62% | -5 |

| Nov. 2024 | 97.5 | 6.62% | -8 |

| Dec. 2024 | 102 | 6.70% | -7 |

| Feb. 2025 | 96 | 6.79% | -4 |

| Jun. 2025 | 96 | 6.83% | -4 |

| Nov. 2026 | 97.5 | 6.93% | -7 |

| Nov. 2027 | 97.5 | 7.06% | -3 |

| Nov. 2028 | 96.5 | 7.07% | -6 |

| Feb. 2030 | 94.5 | 7.27% | 0 |

| Nov. 2035 | 97 | 7.34% | 0 |