Higher Demand for Lebanese Eurobonds on Tuesday

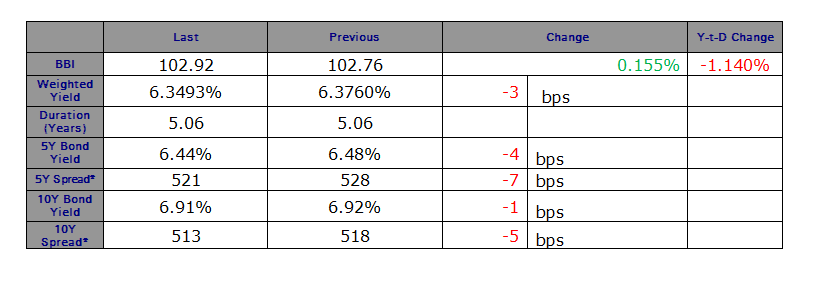

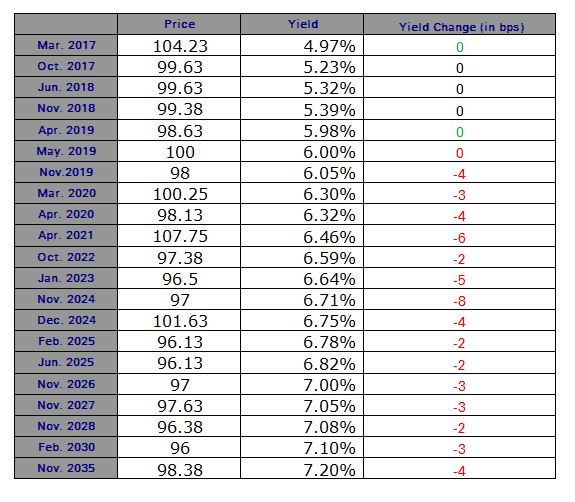

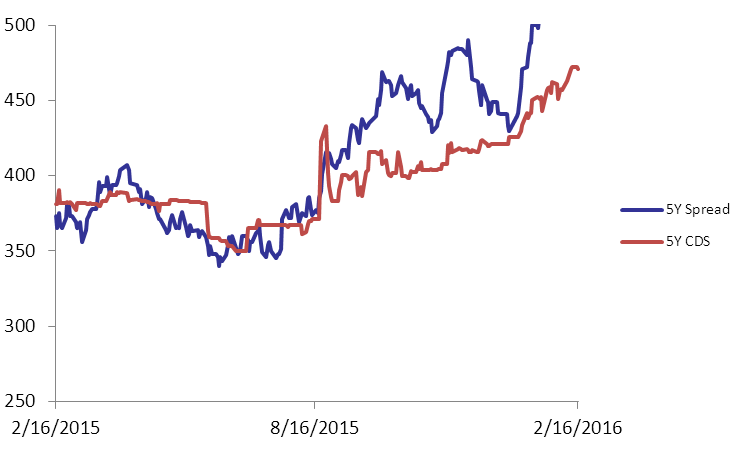

Demand for Lebanese Eurobonds increased on Tuesday, as the BLOM Bond Index (BBI) merely went up by 0.16% to reach 102.92 points. The yields on the 5Y and 10Y Lebanese Eurobonds dropped by 4 basis points and 1 basis point (bp) to settle at 6.44% and 6.91%, respectively. Demand for medium term US notes went in the opposite direction as the 5Y yield went up by 3 bps to 1.23%. Hence, the spread between the 5Y yield on the Lebanese Eurobonds and that of the US treasury narrowed by 7 bps to 521 bps. Lebanon’s 5Y Credit Default Swaps (CDS) barely dropped from their previous quotes of 462-482 bps to 461-481 bps.