Improved Demand for Lebanese Eurobonds on Friday

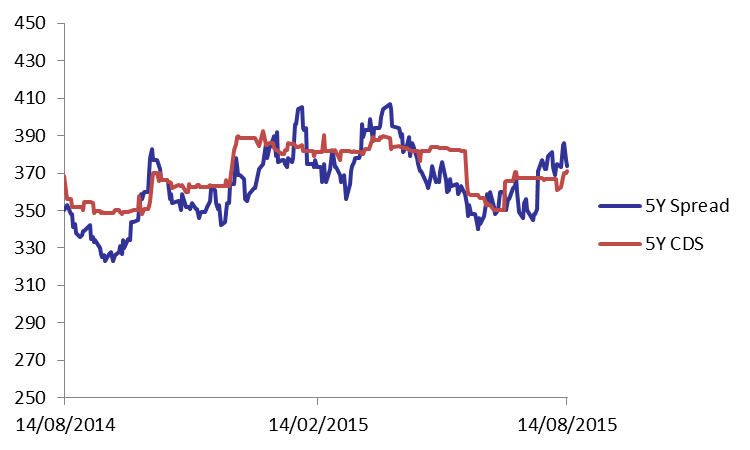

On the Lebanese Eurobonds market, demand for short and long term Lebanese Eurobonds improved causing the BLOM Bond Index (BBI) to tick up by 0.06% to 107.21 points on Friday. The yields on the 10Y Lebanese Eurobonds declined by 1 basis point (bp) to 6.20% while that of the 5Y steadied at 5.35%. Meanwhile, demand for medium term US notes fell illustrated by the 3 bps ascent to 1.61% on the yield of the mentioned maturity. Consequently, the spread between Lebanese Eurobonds and their US counterpart narrowed by 3 bps to 374 bps. The Lebanese 5Y Credit Default Swaps (CDS) remained at their previous quotes of 358-383 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 107.208 | 107.148 | 0.06% | -0.24% | |

| Weighted Yield | 5.46% | 5.48% | 0 | bps | |

| Duration (Years) | 5.05 | 5.05 | |||

| 5Y Bond Yield | 5.35% | 5.35% | 0 | bps | |

| 5Y Spread* | 374 | 377 | -3 | bps | |

| 10Y Bond Yield | 6.20% | 6.21% | -1 | bps | |

| 10Y Spread* | 400 | 402 | -2 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.87 | 4.01% | 0 |

| Mar. 2017 | 107.22 | 4.28% | 0 |

| Oct. 2017 | 101.11 | 4.45% | 0 |

| Jun. 2018 | 101.43 | 4.60% | 0 |

| Nov. 2018 | 101.17 | 4.75% | -10 |

| Apr. 2019 | 101.25 | 5.12% | 0 |

| Mar. 2020 | 104 | 5.37% | 0 |

| Apr. 2020 | 101.63 | 5.40% | -3 |

| Apr. 2021 | 113 | 5.54% | 0 |

| Oct. 2022 | 101.88 | 5.77% | -2 |

| Jan. 2023 | 101 | 5.83% | 2 |

| Dec. 2024 | 107 | 6.01% | -3 |

| Feb. 2025 | 101.13 | 6.04% | -2 |

| Nov. 2026 | 103 | 6.22% | -1 |

| Nov. 2027 | 104 | 6.28% | -1 |

| Feb. 2030 | 102.25 | 6.41% | -1 |