Improved Demand for Lebanese Eurobonds on Wednesday

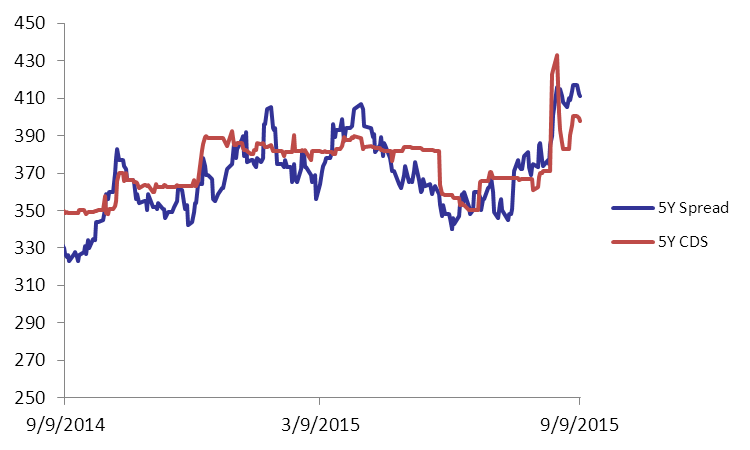

Appetite for short term and medium term Lebanese Eurobonds was evident which caused the BLOM Bond Index (BBI) to uptick by 0.06% to 105.70 points. Yield on the 10Y Lebanese Eurobonds added 1 basis point (bp) to 6.44% while that of the 5Y dropped by 1 bp to 5.64%. On the other hand, demand for medium-term US notes stagnated with the 5Y steadying at 1.53%, over the same period. Accordingly, the 5Y spread between Lebanese Eurobonds and their US counterpart slightly narrowed from 412 bps to 411 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they tightened from their pervious quotes of 387-412 bps to 385-410 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.704 | 105.643 | 0.058% | -1.64% | |

| Weighted Yield | 5.76% | 5.78% | -2 | bps | |

| Duration (Years) | 5.00 | 5.00 | |||

| 5Y Bond Yield | 5.64% | 5.65% | -1 | bps | |

| 5Y Spread* | 411 | 412 | -1 | bps | |

| 10Y Bond Yield | 6.44% | 6.43% | 1 | bps | |

| 10Y Spread* | 423 | 423 | 0 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.55 | 4.25% | -5 |

| Mar. 2017 | 106.25 | 4.72% | -14 |

| Oct. 2017 | 100.29 | 4.85% | -15 |

| Jun. 2018 | 100.38 | 5.00% | -10 |

| Nov. 2018 | 100 | 5.15% | 0 |

| Apr. 2019 | 100.63 | 5.30% | 4 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.63 | 5.64% | 0 |

| Apr. 2021 | 110.75 | 5.96% | 0 |

| Oct. 2022 | 100.75 | 5.97% | -2 |

| Jan. 2023 | 99.88 | 6.02% | -2 |

| Dec. 2024 | 105.5 | 6.21% | 0 |

| Feb. 2025 | 99.63 | 6.25% | -2 |

| Nov. 2026 | 100.65 | 6.52% | 1 |

| Nov. 2027 | 101.5 | 6.57% | 0 |

| Feb. 2030 | 99.75 | 6.68% | -3 |