Improved Demand for Short-Term Lebanese Eurobonds

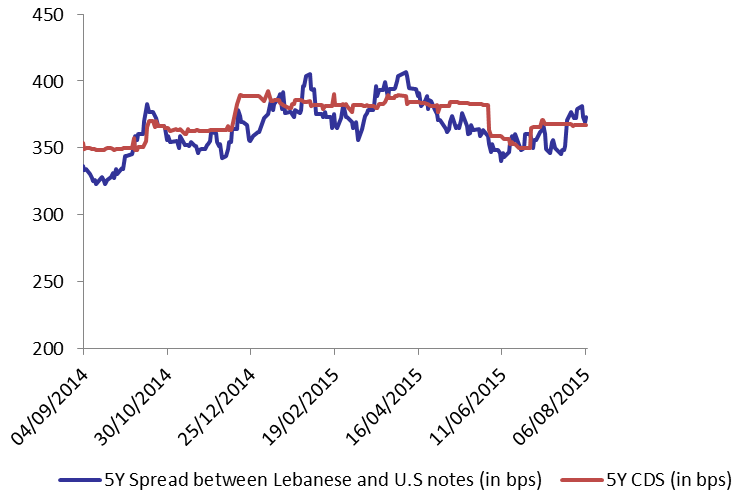

Demand for short-term Lebanese Eurobonds progressed on Thursday which compensated the weakened demand for long term ones. Accordingly, the BLOM Bond Index (BBI) slightly up ticked by 0.01% to 107.13 points. The yield on the 10Y Lebanese Eurobonds went up by 1 basis pont (bp) to 6.23% while that of the 5Y steadied at 5.34%. The spread between the yield on the 5Y Lebanese Eurobonds and its US counterpart broadened by 3 bps to 372 bps as the demand for medium-term US notes strengthened. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) remained at their previous quotes of 350-383 bps.

| 0 | Last | Previous | Change | Y-t-D Change | |

| BBI | 107.131 | 107.116 | 0.01% | -0.31% | |

| Weighted Yield | 5.47% | 5.48% | -1 | bps | |

| Duration (Years) | 5.07 | 5.07 | |||

| 5Y Bond Yield | 5.34% | 5.34% | 0 | bps | |

| 5Y Spread* | 372 | 369 | 3 | bps | |

| 10Y Bond Yield | 6.23% | 6.22% | 1 | bps | |

| 10Y Spread* | 400 | 394 | 6 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.88 | 4.01% | 1 |

| Mar. 2017 | 107.31 | 4.28% | 2 |

| Oct. 2017 | 101.12 | 4.45% | 0 |

| Jun. 2018 | 101.44 | 4.60% | 0 |

| Nov. 2018 | 101.19 | 4.75% | 0 |

| Apr. 2019 | 101.38 | 5.09% | 0 |

| Mar. 2020 | 104 | 5.38% | 0 |

| Apr. 2020 | 101.63 | 5.40% | 0 |

| Apr. 2021 | 113 | 5.55% | 0 |

| Oct. 2022 | 101.88 | 5.77% | 0 |

| Jan. 2023 | 101 | 5.83% | 0 |

| Dec. 2024 | 106.88 | 6.02% | 0 |

| Feb. 2025 | 100.75 | 6.09% | 0 |

| Nov. 2026 | 102.75 | 6.26% | 0 |

| Nov. 2027 | 103.75 | 6.31% | 0 |

| Feb. 2030 | 101.75 | 6.46% | -3 |