Improved Demand on Friday Boosted the Lebanese Eurobonds Market

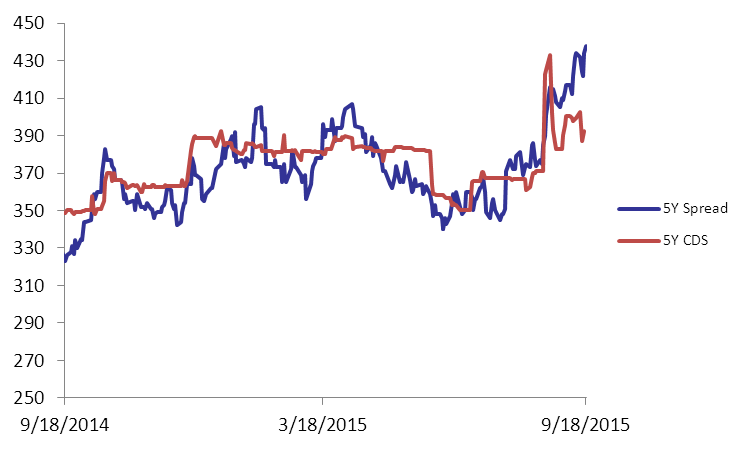

The postponed of interest rates’ hike on the US front coupled with continuous problems on the Lebanese political scene seemed to have weighed in favor of the Lebanese fixed income market. Accordingly, the BLOM Bond Index (BBI) increased by 0.03% to 105.72 points, narrowing its year-to-date loss to 1.63%. Yield on the 10Y Lebanese Eurobonds remained at its previous level of 6.35% for the 3rd consecutive session, while that of the 5Y dropped by 1 basis point (bp) to5.83%. Demand for medium-term US notes strengthened on Friday,causing the 5Y spread between the 5Y Lebanese and US notes to broaden by 4 bps to 438 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they narrowed from their pervious quotes of 375-405 bps to 373-400 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.722 | 105.690 | 0.03% | -1.63% | |

| Weighted Yield | 5.74% | 5.75% | -1 | bps | |

| Duration (Years) | 4.98 | 4.98 | |||

| 5Y Bond Yield | 5.83% | 5.84% | -1 | bps | |

| 5Y Spread* | 438 | 434 | 4 | bps | |

| 10Y Bond Yield | 6.35% | 6.35% | 0 | bps | |

| 10Y Spread* | 422 | 414 | 8 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.59 | 4.20% | 0 |

| Mar. 2017 | 106.25 | 4.65% | -1 |

| Oct. 2017 | 100.38 | 4.80% | 0 |

| Jun. 2018 | 100.38 | 5.00% | 0 |

| Nov. 2018 | 100.13 | 5.10% | -5 |

| Apr. 2019 | 100.75 | 5.27% | 0 |

| May. 2019 | 102.25 | 5.31% | 0 |

| Nov.2019 | 100 | 5.45% | -3 |

| Mar. 2020 | 103.13 | 5.57% | -3 |

| Apr. 2020 | 100.75 | 5.61% | -3 |

| Apr. 2021 | 110.88 | 5.93% | 0 |

| Oct. 2022 | 100.5 | 6.01% | -2 |

| Jan. 2023 | 99.63 | 6.06% | -2 |

| Dec. 2024 | 105.25 | 6.24% | -2 |

| Feb. 2025 | 99.5 | 6.27% | -2 |

| Jun. 2025 | 99.5 | 6.32% | -2 |

| Nov. 2026 | 100.75 | 6.50% | 1 |

| Nov. 2027 | 101.5 | 6.57% | 2 |

| Feb. 2030 | 99.75 | 6.68% | 1 |