Latest Political Events Weakened Demand for Lebanese Eurobonds Yesterday

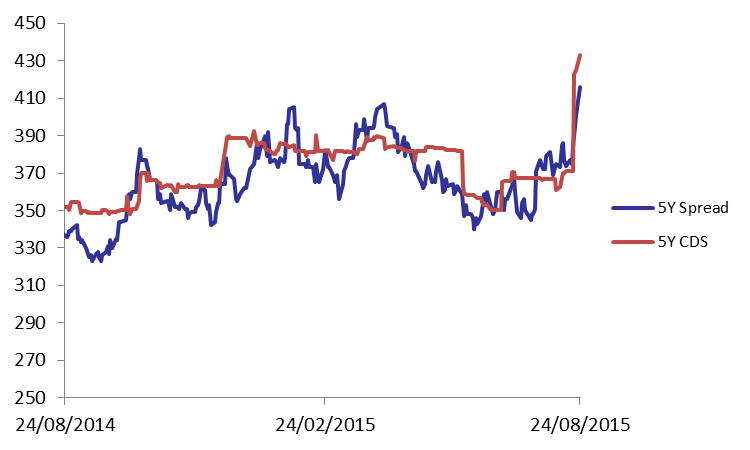

Demand on Lebanese Eurobonds weakened significantly on Monday for the 5th consecutive session, as its becoming more apparent that the shaky political situation is taking its toll on the Eurobonds market. Accordingly, the BLOM Bond Index (BBI) went down by 0.41% to 106.16 points, widening its year-to-date loss to 1.22%. The yields on the 5Y and 10Y Lebanese Eurobonds increased by 10 basis points (bps) and 6 bps to reach respective levels of 5.55% and 6.36%. The 5Y spread between Lebanese Eurobonds and their US counterpart broadened by 15 bps to 416 bps as demand for medium term US notes improved for the 3rd session running. The Lebanese 5Y Credit Default Swaps (CDS) broadened from their previous quotes of 405-445 bps to 418-448 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 106.158 | 106.591 | -0.41% | -1.22% | |

| Weighted Yield | 5.67% | 5.58% | 9 | bps | |

| Duration (Years) | 5.01 | 5.03 | |||

| 5Y Bond Yield | 5.55% | 5.45% | 10 | bps | |

| 5Y Spread* | 416 | 401 | 15 | bps | |

| 10Y Bond Yield | 6.36% | 6.30% | 6 | bps | |

| 10Y Spread* | 435 | 425 | 10 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.8 | 4.05% | 0 |

| Mar. 2017 | 106.5 | 4.66% | 18 |

| Oct. 2017 | 100.75 | 4.62% | 7 |

| Jun. 2018 | 100.75 | 4.86% | 11 |

| Nov. 2018 | 100.5 | 4.98% | 8 |

| Apr. 2019 | 101.75 | 4.97% | -23 |

| Mar. 2020 | 103 | 5.62% | 15 |

| Apr. 2020 | 100.75 | 5.61% | 9 |

| Apr. 2021 | 111 | 5.92% | 24 |

| Oct. 2022 | 100.75 | 5.97% | 9 |

| Jan. 2023 | 100 | 6.00% | 7 |

| Dec. 2024 | 106 | 6.14% | 3 |

| Feb. 2025 | 100.5 | 6.13% | -2 |

| Nov. 2026 | 101.5 | 6.41% | 6 |

| Nov. 2027 | 102.5 | 6.45% | 6 |

| Feb. 2030 | 101 | 6.54% | 1 |