Lebanese Eurobonds Kept their Momentum for the Third Session in a Row

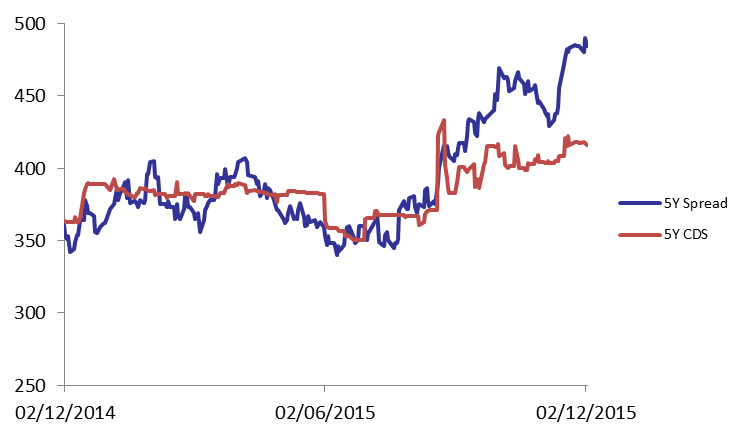

The Lebanese Eurobonds Market remained in the green for the third session running, as the BLOM Bond Index (BBI) gained 0.18% to 102.90 points. Yields on the 5Y and 10Y Lebanese Eurobonds dropped 2 basis points (bps) each to 6.47% and 6.88%, respectively. In the US, demand for medium term maturities dropped, narrowing the 5Y yield spread between the Lebanese Eurobonds and their US comparable by 6 bps to 484 bps. As for the 5Y Credit Default Swaps, they tightened marginally from 407-427 to 406-426 bps.

*Between Lebanese and U.S notes

Last

Previous

Change

Y-t-D Change

BBI

102.896

102.712

0.179%

-4.26%

Weighted Yield

6.40%

6.44%

-4

bps

Duration (Years)

5.24

5.24

5Y Bond Yield

6.47%

6.49%

-2

bps

5Y Spread*

484

490

-6

bps

10Y Bond Yield

6.88%

6.90%

-2

bps

10Y Spread*

470

475

-5

bps

Price

Yield

Yield Change (in bps)

Mar. 2017

104.5

5.36%

-10

Oct. 2017

99.25

5.43%

-14

Jun. 2018

99.25

5.47%

-11

Nov. 2018

99.00

5.52%

-9

Apr. 2019

98.5

5.99%

0

May. 2019

99.5

6.16%

0

Nov.2019

97.5

6.17%

0

Mar. 2020

100.25

6.30%

0

Apr. 2020

98

6.33%

0

Apr. 2021

107.5

6.56%

-5

Oct. 2022

97.5

6.56%

0

Jan. 2023

96.75

6.58%

-5

Nov. 2024

97.25

6.66%

4

Dec. 2024

102.13

6.68%

-2

Feb. 2025

96.5

6.71%

-8

Jun. 2025

96.5

6.75%

-7

Nov. 2026

97.5

6.93%

-3

Nov. 2027

98.13

6.98%

-6

Nov. 2028

96.5

7.07%

-1

Feb. 2030

95.5

7.16%

-3

Nov. 2035

98

7.24%

-2