Medium and Long-term Lebanese Eurobonds Started the Week with an Improvement

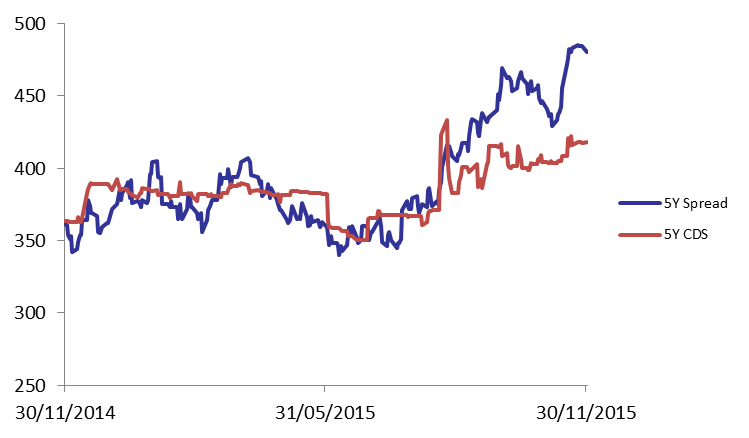

Demand for Lebanese Eurobonds improved at the start of the week, with the BLOM Bond Index (BBI) adding 0.13% to 102.56 points. Yields on the 5Y and 10Y Lebanese Eurobonds lost 3 basis points (bps) and 4 bps to 6.45% and 6.84%, respectively. In the US, demand for medium term maturities decreased, narrowing the 5Y yield spread between the Lebanese Eurobonds and their US comparable by 4 bps to 480 bps. As for the 5Y Credit Default Swaps, they broadened slightly to 408-428 bps from a previous quote of 407-427 bps.

*Between Lebanese and U.S notes

Last

Previous

Change

Y-t-D Change

BBI

102.558

102.427

0.128%

-4.57%

Weighted Yield

6.44%

6.45%

-1

bps

Duration (Years)

5.14

5.11

5Y Bond Yield

6.45%

6.48%

-3

bps

5Y Spread*

480

484

-4

bps

10Y Bond Yield

6.84%

6.88%

-4

bps

10Y Spread*

463

466

-3

bps

Price

Yield

Yield Change (in bps)

Nov. 2016

100

4.75%

0

Mar. 2017

104.38

5.47%

7

Oct. 2017

99

5.57%

15

Jun. 2018

99

5.58%

0

Nov. 2018

98.75

5.61%

9

Apr. 2019

98.5

5.99%

-17

May. 2019

99.13

6.28%

-4

Nov.2019

97

6.31%

0

Mar. 2020

100.13

6.34%

-4

Apr. 2020

97.88

6.36%

-3

Apr. 2021

107.13

6.65%

-3

Oct. 2022

97.13

6.63%

-2

Jan. 2023

96.25

6.67%

0

Nov. 2024

97.25

6.66%

-4

Dec. 2024

101.75

6.74%

-4

Feb. 2025

95.88

6.81%

-2

Jun. 2025

95.88

6.85%

-2

Nov. 2026

97.13

6.98%

-8

Nov. 2027

97.63

7.05%

-5

Nov. 2028

96.38

7.08%

-5

Feb. 2030

95.25

7.19%

-3

Nov. 2035

97.5

7.29%

0