Mixed Demand for Lebanese Eurobonds on Tuesday

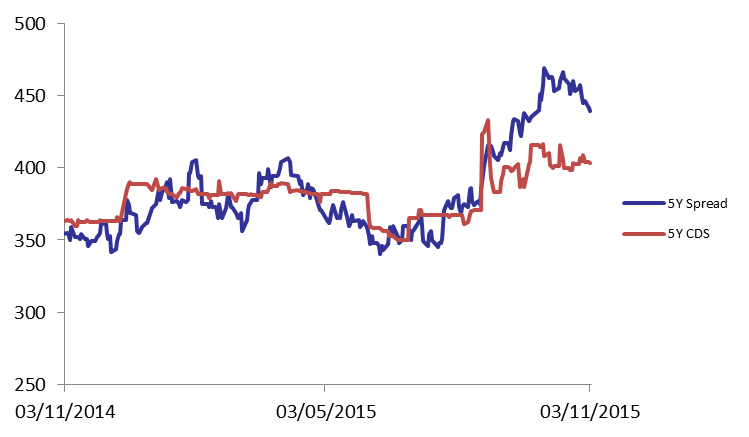

Demand for short term Lebanese Eurobonds progressed on Tuesday but was offset by the weakened appetite for long term notes. Accordingly, the BLOM Bond Index (BBI) ticked down slightly by 0.01% to 104.86 points, registering a year-to-date loss of 2.43%. Yield of 10Y Lebanese Eurobonds went up by 2 basis points (bps) to 6.47% while that of the 5Y steadied at 5.98% for the fourth session running. On the other hand, demand for medium term maturities in the U.S. weakened causing the 5Y spread between the Lebanese Eurobonds and their U.S counterpart to narrow by 2 bps to 439 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they steadied at 391-416 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.856 | 104.862 | -0.006% | -2.43% | |

| Weighted Yield | 5.93% | 5.93% | 0 | bps | |

| Duration (Years) | 4.89 | 4.89 | |||

| 5Y Bond Yield | 5.98% | 5.98% | 0 | bps | |

| 5Y Spread* | 439 | 441 | -2 | bps | |

| 10Y Bond Yield | 6.47% | 6.45% | 2 | bps | |

| 10Y Spread* | 424 | 425 | -1 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.38 | 4.36% | 1 |

| Mar. 2017 | 105.38 | 4.91% | -1 |

| Oct. 2017 | 99.75 | 5.14% | 0 |

| Jun. 2018 | 99.75 | 5.25% | 0 |

| Nov. 2018 | 99.5 | 5.33% | -4 |

| Apr. 2019 | 100 | 5.50% | 0 |

| May. 2019 | 101.25 | 5.61% | 0 |

| Nov.2019 | 98.75 | 5.80% | 0 |

| Mar. 2020 | 102 | 5.85% | 0 |

| Apr. 2020 | 99.75 | 5.86% | 0 |

| Apr. 2021 | 110 | 6.06% | 0 |

| Oct. 2022 | 99.63 | 6.17% | 0 |

| Jan. 2023 | 98.88 | 6.19% | 0 |

| Dec. 2024 | 104.25 | 6.38% | 4 |

| Feb. 2025 | 98.75 | 6.38% | 2 |

| Jun. 2025 | 98.75 | 6.43% | 2 |

| Nov. 2026 | 100.13 | 6.58% | -2 |

| Nov. 2027 | 101 | 6.63% | 0 |

| Feb. 2030 | 98.5 | 6.81% | 1 |