Mixed Demand for Lebanese Eurobonds on Wednesday

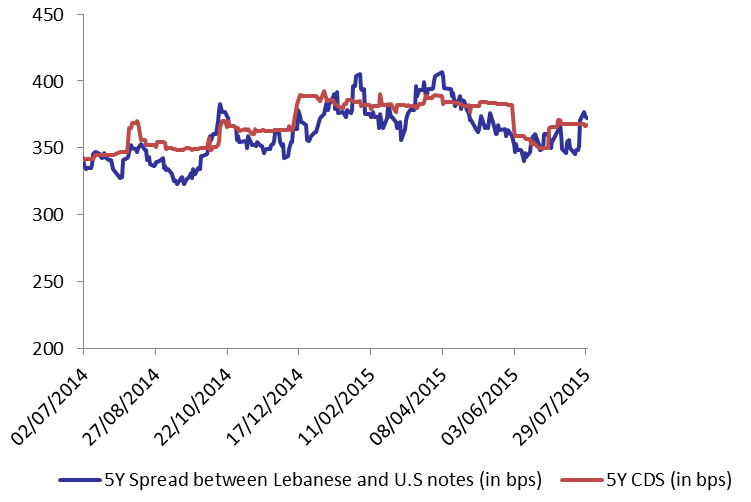

On Wednesday, demand for short and long term Lebanese Eurobonds slightly improved which was offset by the fall in demand for medium term ones. Consequently, the BLOM Bond Index (BBI) barely ticked up by 0.003% to 107.08 points. The yield on the 10Y Lebanese Eurobonds remained 6.21% while that of the 5Y marginally dropped by 1 basis point (bp) to 5.34%. The spread between the yield on the 5Y Lebanese Eurobonds and its US comparable narrowed by 2 basis points (bps) to 372 as the demand for medium-term US notes fell. Meanwhile, the Lebanese 5Y Credit Default Swaps (CDS) slightly broadened from their previous range of 354-378 bps to 355-379 bps.

| Last | Previous | Change | Y-t-D %Change | ||

| BBI | 107.082 | 107.079 | 0.003% | -0.36% | |

| Weighted Yield | 5.49% | 5.49% | 0 | bps | |

| Duration (Years) | 5.09 | 5.09 | |||

| 5Y Bond Yield | 5.34% | 5.35% | -1 | bps | |

| 5Y Spread* | 372 | 374 | -2 | bps | |

| 10Y Bond Yield | 6.21% | 6.21% | 0 | bps | |

| 10Y Spread* | 392 | 395 | -3 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.75 | 4.13% | -1 |

| Mar. 2017 | 107.4 | 4.28% | -4 |

| Oct. 2017 | 100.8 | 4.61% | 0 |

| Jun. 2018 | 101.46 | 4.60% | 0 |

| Nov. 2018 | 100.88 | 4.85% | 0 |

| Apr. 2019 | 101.75 | 4.98% | 0 |

| Mar. 2020 | 104.13 | 5.35% | 3 |

| Apr. 2020 | 101.63 | 5.40% | 3 |

| Apr. 2021 | 113 | 5.56% | -1 |

| Oct. 2022 | 101.88 | 5.77% | 0 |

| Jan. 2023 | 101 | 5.83% | -4 |

| Dec. 2024 | 106.75 | 6.04% | 0 |

| Feb. 2025 | 100.88 | 6.08% | -2 |

| Nov. 2026 | 102.5 | 6.29% | 0 |

| Nov. 2027 | 103.5 | 6.34% | 0 |

| Feb. 2030 | 101.5 | 6.49% | 0 |