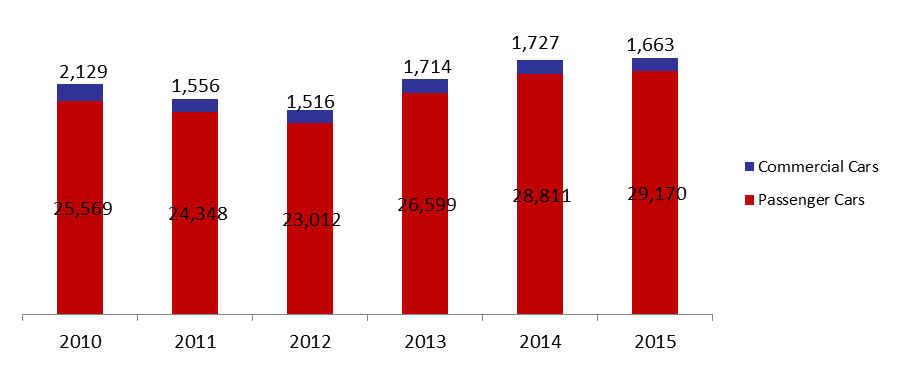

Number of Registered Cars Stagnated by September

According to the Association of Lebanese Car Importers, the number of newly registered commercial and passenger cars during the first 9 months of 2015 expanded by a mere 0.96% year-on-year (y-o-y) up to September to reach 30,832 cars. This might have been on the back of decreasing oil prices and the depreciating Euro and Yen.

Worth mentioning that a press release from the Association of Lebanese Car Importers stated that the orientation of the market was towards small cars mainly on the back of an absence of a public transport system and the drop in the purchasing power of the consumers.

In details, the above improvement was attributed to the yearly 1.25% increase to 29,170 by September in newly registered passenger cars, which was partially offset by the 3.71% annual fall in newly registered commercial cars to 1,666. A possible explanation for the weakening demand for commercial cars is the hesitance of the commercial sector amid the presidential vacuum and political uncertainty in Lebanon.

Notably, there was a change in the market share of car exporting-countries, due to the average 13% and 15% y-o-y depreciation of both the Euro and the Japanese Yen against the US dollar to respective levels of Euro/Dollar 1.1288 and Dollar/Yen 119.59, by End-September. For instance, Japanese cars were the most demanded cars in Lebanon in the first 9 months, with their share improving from 34.35% in 2014, to 39.77% in 2015. Notably, most Japanese cars saw a yearly improvement in imports with main jumps witnessed in Toyota and Suzuki cars. Meanwhile Korean cars lost their hold on the number one spot, going down from 40.46% to 32.80% in 2015. European cars maintained their third rank, however with a higher market share of 21.01%, compared to 18.86% in 2014.

Looking at the car brand breakdown, Kia held the largest share of 18.03% of the total, followed by 16.14% for Toyota. Furthermore, Hyundai and Nissan respectively grasped shares of 14.98% and 10.48%.

In terms of sales per importer, NATCO SAL (imports Korean manufactured Kia) maintained its holding as top performer, grasping a 17.75% share, while BUMC (imports Japanese made Toyota and Lexus) and Century Motor Co (imports Korean produced Hyundai) captured 16.29% and 14.98% of the market, respectively.

Breakdown of Passenger and Commercial Cars by September

Source: AIA