Progressing Appetite for Lebanese Eurobonds on Wednesday

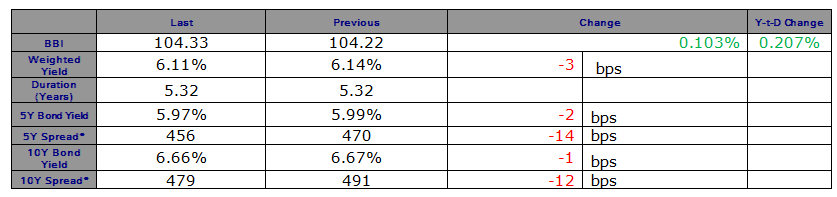

Demand for most Lebanese Eurobonds increased on Wednesday, pulling the BLOM Bond Index (BBI) up by 0.10% to 104.33 points.

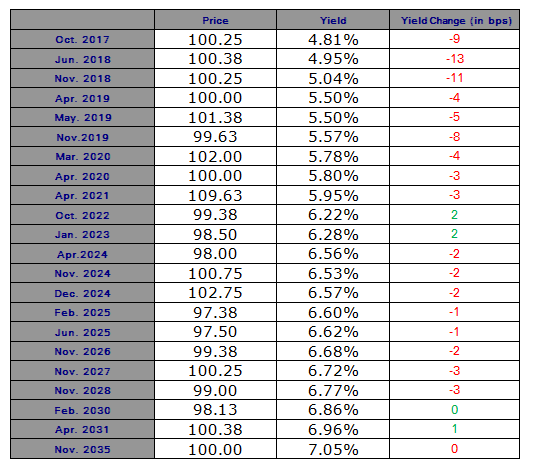

The yield on the Lebanese Eurobonds maturing in 5 years dropped by 2 basis points (bps) to 5.97%, while that of the Lebanese Eurobonds maturing in 10 years lost 1 bp to 6.66%.

As demand for U.S treasuries maturing in 5 years weakened significantly, the spread between the yield on the 5 Year Lebanese Eurobonds and the yield on their US comparable narrowed by 14 points to 456 bps.

The bid-ask range for Lebanon’s 5Y Credit Default Swaps (CDS) remained unchanged at their previous level of 447-467 bps.