Quiet Day on the Lebanese Eurobonds Market on Thursday

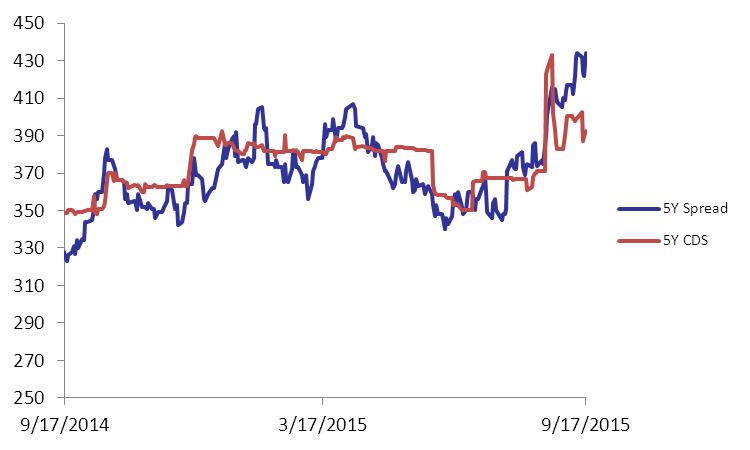

Demand was shy for Lebanese Eurobonds on Thursday, partially due to uncertainty on the Lebanese political scene coupled with developing markets awaiting the Fed’s decision on a rate hike. The BLOM Bond Index (BBI) steadied at 105.69 points, with a year-to-date loss of 1.66%. Yield on the 5Y and 10Y Lebanese Eurobonds remained at their previous levels of 5.84% and 6.35%, respectively. Demand for medium-term US notes strengthened with the 5Y spread between both notes broadening by 12 bps to 434 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they widened from their pervious quotes of 379-406 bps to 375-405 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.690 | 105.690 | – | -1.66% | |

| Weighted Yield | 5.75% | 5.75% | 0 | bps | |

| Duration (Years) | 4.98 | 4.98 | |||

| 5Y Bond Yield | 5.84% | 5.84% | 0 | bps | |

| 5Y Spread* | 434 | 422 | 12 | bps | |

| 10Y Bond Yield | 6.35% | 6.35% | 0 | bps | |

| 10Y Spread* | 414 | 405 | 9 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.59 | 4.20% | 0 |

| Mar. 2017 | 106.25 | 4.66% | -1 |

| Oct. 2017 | 100.38 | 4.80% | 0 |

| Jun. 2018 | 100.38 | 5.00% | 0 |

| Nov. 2018 | 100 | 5.15% | 0 |

| Apr. 2019 | 100.75 | 5.27% | 0 |

| May. 2019 | 102.25 | 5.32% | 0 |

| Nov.2019 | 99.88 | 5.48% | 0 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.63 | 5.64% | 0 |

| Apr. 2021 | 110.88 | 5.93% | 0 |

| Oct. 2022 | 100.38 | 6.03% | 0 |

| Jan. 2023 | 99.5 | 6.08% | 0 |

| Dec. 2024 | 105.13 | 6.26% | 0 |

| Feb. 2025 | 99.38 | 6.29% | 0 |

| Jun. 2025 | 99.38 | 6.33% | 0 |

| Nov. 2026 | 100.85 | 6.49% | 0 |

| Nov. 2027 | 101.63 | 6.55% | 0 |

| Feb. 2030 | 99.88 | 6.66% | 0 |