Stable Demand on the Lebanese Eurobond Market

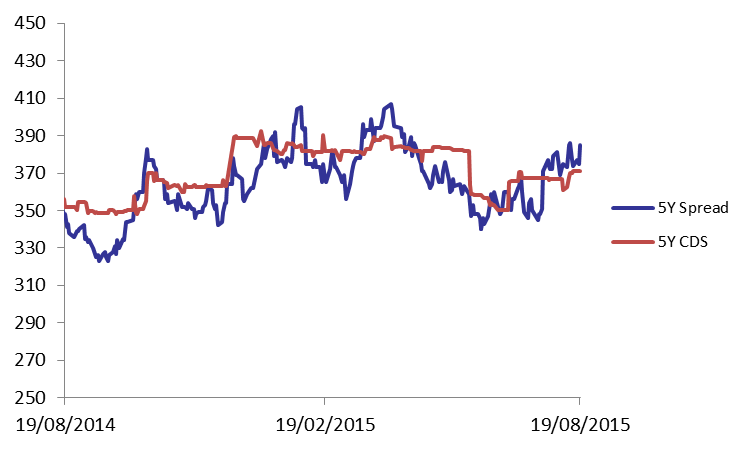

On the Lebanese Eurobonds market, demand remained relatively unchanged as the BLOM Bond Index (BBI) down ticked by a marginal 0.001% to 107.208 points on Wednesday. The yields on the 5Y and 10Y Lebanese Eurobonds steadied at respective levels of 5.35% and 6.20% for the 4th consecutive session. On the US front, demand for medium term US notes improved mainly following the 10 basis points (bps) slip of the 5Y notes’ yield that reached 1.50%. Accordingly, the spread between Lebanese Eurobonds and their US equivalent broadened by 10 bps to 385 bps. The Lebanese 5Y Credit Default Swaps (CDS) remained at their previous quotes of 358-383 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 107.208 | 107.209 | -0.001% | -0.24% | |

| Weighted Yield | 5.46% | 5.46% | 0 | bps | |

| Duration (Years) | 5.04 | 5.04 | |||

| 5Y Bond Yield | 5.35% | 5.35% | 0 | bps | |

| 5Y Spread* | 385 | 375 | 10 | bps | |

| 10Y Bond Yield | 6.20% | 6.20% | 0 | bps | |

| 10Y Spread* | 408 | 400 | 8 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.86 | 4.01% | 0 |

| Mar. 2017 | 107.18 | 4.27% | 0 |

| Oct. 2017 | 101.11 | 4.45% | 0 |

| Jun. 2018 | 101.43 | 4.60% | 0 |

| Nov. 2018 | 101.17 | 4.75% | 0 |

| Apr. 2019 | 101.38 | 5.08% | 0 |

| Mar. 2020 | 104 | 5.37% | 0 |

| Apr. 2020 | 101.63 | 5.40% | 0 |

| Apr. 2021 | 113 | 5.54% | 0 |

| Oct. 2022 | 101.88 | 5.77% | 0 |

| Jan. 2023 | 101 | 5.83% | 0 |

| Dec. 2024 | 107 | 6.00% | 0 |

| Feb. 2025 | 101.13 | 6.04% | 0 |

| Nov. 2026 | 103 | 6.22% | 0 |

| Nov. 2027 | 104 | 6.28% | 0 |

| Feb. 2030 | 102.25 | 6.41% | 0 |