Stagnant Activity on the Lebanese Eurobonds Market on Thursday

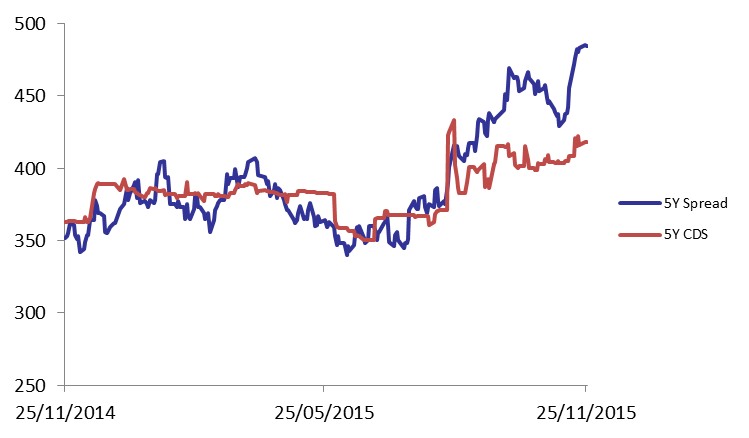

The BLOM Bond Index (BBI) stabilized at 102.72 points on Thursday with the yields on the Lebanese Eurobonds maturing in five and ten years steadying at 6.50% and 6.87%, respectively. Both the 5Y yield spread between the Lebanese Eurobonds and their US comparable and Lebanon’s 5Y Credit Default Swaps stood still at 484 bps and 408-428 bps, respectively.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 102.724 | 102.724 | 0.000% | -4.42% | |

| Weighted Yield | 6.37% | 6.37% | 0 | bps | |

| Duration (Years) | 5.11 | 5.11 | |||

| 5Y Bond Yield | 6.50% | 6.50% | 0 | bps | |

| 5Y Spread* | 484 | 484 | 0 | bps | |

| 10Y Bond Yield | 6.87% | 6.87% | 0 | bps | |

| 10Y Spread* | 464 | 464 | 0 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100 | 4.75% | 0 |

| Mar. 2017 | 105 | 5.03% | -39 |

| Oct. 2017 | 99.38 | 5.35% | -14 |

| Jun. 2018 | 99 | 5.58% | 0 |

| Nov. 2018 | 99 | 5.52% | -9 |

| Apr. 2019 | 98.5 | 5.99% | 0 |

| May. 2019 | 100 | 6.00% | -24 |

| Nov.2019 | 97.5 | 6.16% | -14 |

| Mar. 2020 | 100 | 6.37% | 0 |

| Apr. 2020 | 98 | 6.33% | -7 |

| Apr. 2021 | 107.5 | 6.57% | -3 |

| Oct. 2022 | 97.25 | 6.60% | -5 |

| Jan. 2023 | 96.5 | 6.62% | -5 |

| Nov. 2024 | 97.5 | 6.62% | -8 |

| Dec. 2024 | 102 | 6.70% | -7 |

| Feb. 2025 | 96 | 6.79% | -4 |

| Jun. 2025 | 96 | 6.83% | -4 |

| Nov. 2026 | 97.5 | 6.93% | -7 |

| Nov. 2027 | 97.5 | 7.06% | -3 |

| Nov. 2028 | 96.5 | 7.07% | -6 |

| Feb. 2030 | 94.5 | 7.27% | 0 |

| Nov. 2035 | 97 | 7.34% | 0 |