Stagnating Demand for Lebanese Eurobonds on Friday

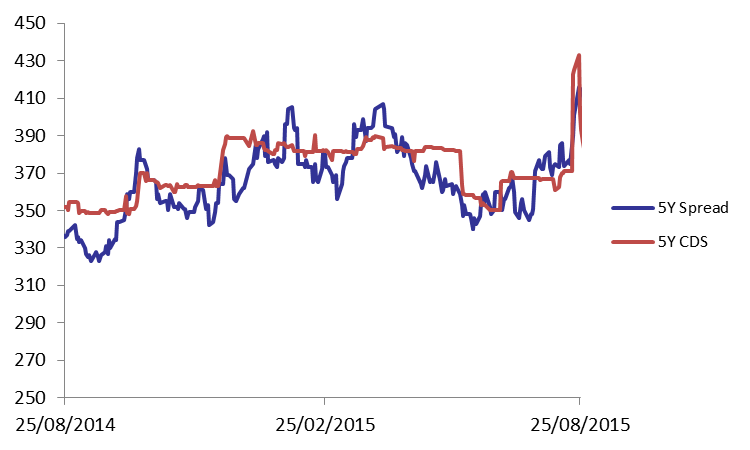

The volatility on the Lebanese Eurobonds market over the past week calmed down on Friday. The BLOM Bond Index (BBI) stagnated at 105.72 points, with a year-to-date loss of 1.63%. Yields on the 5Y and 10Y Lebanese Eurobonds steadied at 5.60% and 6.46%, respectively. On another note, with the drop in demand for U.S. medium term notes, the 5Y spread between Lebanese Eurobonds and their US counterpart narrowed by 3 bps to 408 bps. The Lebanese 5Y Credit Default Swaps (CDS) tightened from their previous quotes of 373-398 bps to 370-395 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.719 | 105.719 | 0.00% | -1.63% | |

| Weighted Yield | 5.74% | 5.74% | 4 | bps | |

| Duration (Years) | 5.03 | 5.03 | |||

| 5Y Bond Yield | 5.60% | 5.60% | 0 | bps | |

| 5Y Spread* | 408 | 411 | -3 | bps | |

| 10Y Bond Yield | 6.46% | 6.46% | 0 | bps | |

| 10Y Spread* | 427 | 428 | -1 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.79 | 4.05% | -1 |

| Mar. 2017 | 106.38 | 4.71% | -1 |

| Oct. 2017 | 100.5 | 4.75% | 0 |

| Jun. 2018 | 100.88 | 4.81% | 0 |

| Nov. 2018 | 100.38 | 5.02% | 0 |

| Apr. 2019 | 100.5 | 5.35% | 0 |

| Mar. 2020 | 103 | 5.62% | 0 |

| Apr. 2020 | 100.75 | 5.61% | 0 |

| Apr. 2021 | 110.75 | 5.97% | 0 |

| Oct. 2022 | 100.75 | 5.97% | 0 |

| Jan. 2023 | 99.88 | 6.02% | 0 |

| Dec. 2024 | 105.63 | 6.19% | 0 |

| Feb. 2025 | 99.25 | 6.31% | 0 |

| Nov. 2026 | 100.5 | 6.53% | 0 |

| Nov. 2027 | 101.25 | 6.60% | 0 |

| Feb. 2030 | 99.5 | 6.70% | 0 |