Stagnation on the Lebanese Eurobonds Market on Tuesday

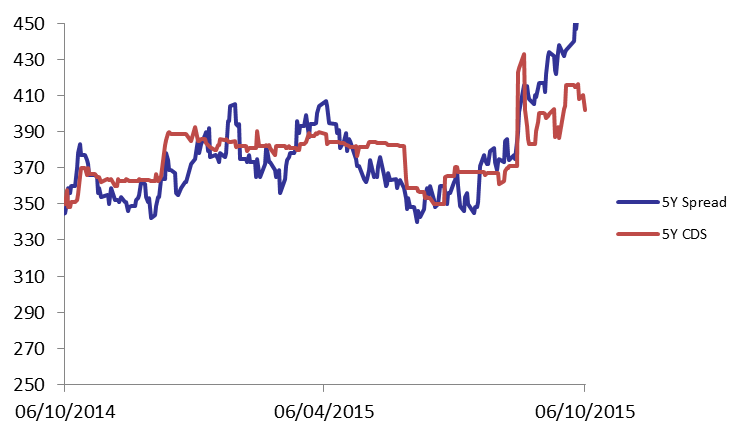

Price of Lebanese Eurobonds witnessed no change for the second session running on Tuesday, as illustrated by the BLOM Bond Index (BBI), which remained at 104.84 points, recording a year-to-date loss of 2.45%. Yields on the 5Y and 10Y Lebanese Eurobonds steadied at 5.97% and 6.48%. As demand for medium-term US notes improved slightly on Tuesday, the spread between the 5Y Lebanese notes and their U.S. counterpart broadened by 1 basis points (bps) to 463 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they narrowed from their previous quote 398-423bps to 391-413 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.842 | 104.842 | 0.00% | -2.45% | |

| Weighted Yield | 5.96% | 5.96% | 0 | bps | |

| Duration (Years) | 5.94 | 5.94 | |||

| 5Y Bond Yield | 5.97% | 5.97% | 0 | bps | |

| 5Y Spread* | 463 | 462 | 1 | bps | |

| 10Y Bond Yield | 6.48% | 6.48% | 0 | bps | |

| 10Y Spread* | 443 | 441 | 2 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.41 | 4.35% | 0 |

| Mar. 2017 | 105.38 | 5.11% | -1 |

| Oct. 2017 | 99.75 | 5.13% | 0 |

| Jun. 2018 | 99.5 | 5.35% | 0 |

| Nov. 2018 | 99.25 | 5.41% | 0 |

| Apr. 2019 | 100 | 5.50% | 0 |

| May. 2019 | 101.13 | 5.65% | 0 |

| Nov.2019 | 98.63 | 5.82% | 0 |

| Mar. 2020 | 102 | 5.85% | 0 |

| Apr. 2020 | 99.75 | 5.86% | 0 |

| Apr. 2021 | 109.75 | 6.14% | 0 |

| Oct. 2022 | 99.75 | 6.14% | 0 |

| Jan. 2023 | 98.88 | 6.19% | 0 |

| Dec. 2024 | 104.38 | 6.36% | 0 |

| Feb. 2025 | 98.63 | 6.40% | 0 |

| Jun. 2025 | 98.63 | 6.44% | 0 |

| Nov. 2026 | 100.25 | 6.57% | 0 |

| Nov. 2027 | 101 | 6.63% | 0 |

| Feb. 2030 | 99 | 6.76% | 0 |