Subdued Activity on the Lebanese Eurobonds Market Yesterday

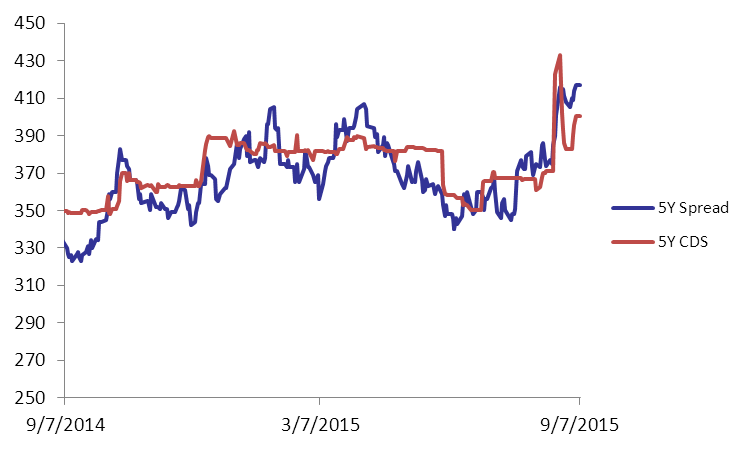

Lebanon’s Eurobonds market saw frail activity on Monday with the BLOM Bond Index (BBI) slipping by a marginal 0.005% to 105.685 points. Yield on the 10Y Lebanese Eurobonds added 1 basis point (bp) to 6.42% while that of the 5Y steadied at 5.64%. On the other hand, demand for medium-term US notes stagnated as markets were closed on Labor Day the 7th of September. Accordingly, the 5Y spread between Lebanese Eurobonds and their US counterpart stagnated at 417 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they were unchanged from their pervious quotes of 388-413 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.685 | 105.690 | -0.005% | -1.66% | |

| Weighted Yield | 5.77% | 5.77% | 0 | bps | |

| Duration (Years) | 5.00 | 5.01 | |||

| 5Y Bond Yield | 5.64% | 5.64% | 0 | bps | |

| 5Y Spread* | 417 | 417 | 0 | bps | |

| 10Y Bond Yield | 6.42% | 6.41% | 1 | bps | |

| 10Y Spread* | 429 | 428 | 1 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.38 | 4.40% | 0 |

| Mar. 2017 | 106.25 | 4.73% | -11 |

| Oct. 2017 | 100 | 5.00% | 10 |

| Jun. 2018 | 100.12 | 5.10% | 0 |

| Nov. 2018 | 100 | 5.15% | 0 |

| Apr. 2019 | 100.811 | 5.25% | -2 |

| Mar. 2020 | 103 | 5.61% | 0 |

| Apr. 2020 | 100.63 | 5.64% | -3 |

| Apr. 2021 | 110.75 | 5.96% | 0 |

| Oct. 2022 | 100.5 | 6.01% | 3 |

| Jan. 2023 | 99.75 | 6.04% | 2 |

| Dec. 2024 | 105.5 | 6.21% | 0 |

| Feb. 2025 | 99.75 | 6.23% | 2 |

| Nov. 2026 | 100.63 | 6.52% | 0 |

| Nov. 2027 | 101.5 | 6.57% | 0 |

| Feb. 2030 | 99.75 | 6.68% | 0 |