Weak Demand for Lebanese Eurobonds on the 1st of October

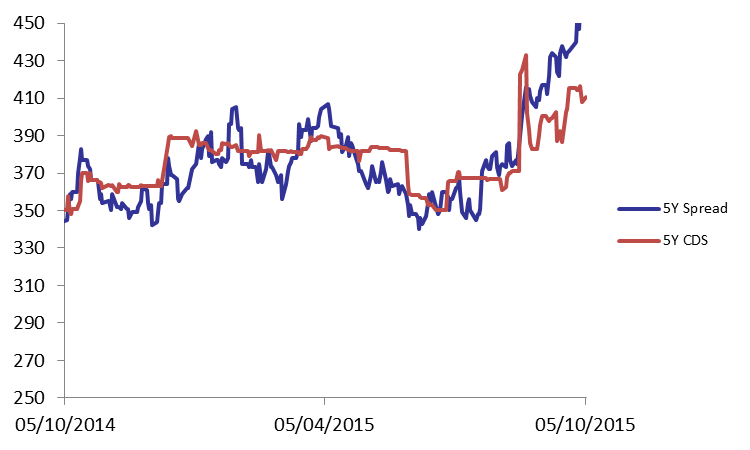

The Lebanese Eurobonds market had a poor showing on Thursday following an improving demand a day earlier. Accordingly, the BLOM Bond Index (BBI) decreased by 0.60%% to 104.74 points, broadening its year-to-date loss to 2.54%. Yields on the 5Y and 10Y Lebanese Eurobonds rose by 10 basis points (bps) and 11 bps to 5.94% and 6.48%, respectively. As demand for medium-term US notes stagnated on Wednesday, the spread between the 5Y Lebanese notes and their U.S. counterpart widened by 10 basis points (bps) to 457 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they broadened slightly from the previous quote 405-428 bps to 403-426 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 104.739 | 105.375 | -0.60% | -2.54% | |

| Weighted Yield | 5.96% | 5.81% | 15 | bps | |

| Duration (Years) | 5.94 | 4.95 | |||

| 5Y Bond Yield | 5.94% | 5.84% | 10 | bps | |

| 5Y Spread* | 457 | 447 | 10 | bps | |

| 10Y Bond Yield | 6.48% | 6.37% | 11 | bps | |

| 10Y Spread* | 443 | 431 | 12 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.57 | 4.20% | 0 |

| Mar. 2017 | 105.5 | 5.07% | 34 |

| Oct. 2017 | 99.63 | 5.19% | 19 |

| Jun. 2018 | 99.5 | 5.35% | 20 |

| Nov. 2018 | 99.25 | 5.41% | 31 |

| Apr. 2019 | 100.25 | 5.42% | 0 |

| May. 2019 | 101 | 5.69% | 23 |

| Nov.2019 | 98.5 | 5.86% | 34 |

| Mar. 2020 | 102.25 | 5.79% | 6 |

| Apr. 2020 | 100 | 5.80% | 3 |

| Apr. 2021 | 109.5 | 6.19% | 25 |

| Oct. 2022 | 99.63 | 6.17% | 7 |

| Jan. 2023 | 99 | 6.17% | 4 |

| Dec. 2024 | 104.5 | 6.34% | 7 |

| Feb. 2025 | 98.5 | 6.41% | 13 |

| Jun. 2025 | 98.5 | 6.46% | 12 |

| Nov. 2026 | 100.13 | 6.58% | 2 |

| Nov. 2027 | 100.88 | 6.64% | 1 |

| Feb. 2030 | 98.63 | 6.80% | 7 |