Weak Performance Marked the Lebanese Eurobonds Market on Friday

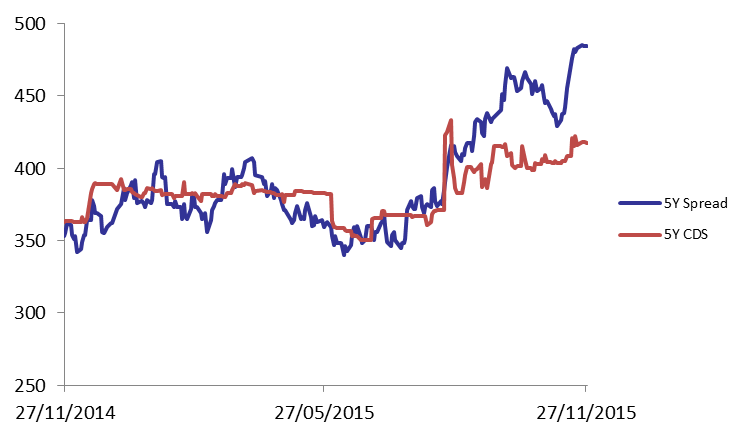

Demand for Lebanese Eurobonds saw a decline on Friday, as shown by the BLOM Bond Index (BBI) that lost 0.29% to 102.43 points. The yield on the 5Y Lebanese Eurobonds lost 2 basis points (bps) to 6.48%, while that of 10Y added 1 bp to 6.88%. in the US, demand for medium term maturities increased at the same pace as their Lebanese counterpart, leaving the 5Y yield spread between the Lebanese Eurobonds and their US comparable unchanged at 484 bps. As for the 5Y Credit Default Swaps, they narrowed slightly from 408-428 bps to 407-427 bps.

*Between Lebanese and U.S notes

Last

Previous

Change

Y-t-D Change

BBI

102.427

102.724

-0.289%

-4.69%

Weighted Yield

6.45%

6.37%

8

bps

Duration (Years)

5.11

5.11

5Y Bond Yield

6.48%

6.50%

-2

bps

5Y Spread*

484

484

–

10Y Bond Yield

6.88%

6.87%

1

bps

10Y Spread*

466

464

2

bps

Price

Yield

Yield Change (in bps)

Nov. 2016

100

4.75%

0

Mar. 2017

104.5

5.40%

38

Oct. 2017

99.25

5.42%

7

Jun. 2018

99

5.58%

0

Nov. 2018

99

5.52%

0

Apr. 2019

98

6.16%

17

May. 2019

99

6.32%

32

Nov.2019

97

6.31%

15

Mar. 2020

100

6.37%

0

Apr. 2020

97.75

6.39%

7

Apr. 2021

107

6.68%

11

Oct. 2022

97

6.65%

5

Jan. 2023

96.25

6.66%

5

Nov. 2024

97

6.70%

8

Dec. 2024

101.5

6.77%

7

Feb. 2025

95.75

6.83%

4

Jun. 2025

95.75

6.86%

4

Nov. 2026

96.5

7.06%

13

Nov. 2027

97.25

7.09%

3

Nov. 2028

96

7.13%

6

Feb. 2030

95

7.22%

-6

Nov. 2035

97.5

7.29%

-5