Among all challenges facing the Lebanese economy, the taxation system is at the core of it. With its narrow base and large holes, taxation does not raise sufficient resources for the country; it is excessively leaky, inefficient and extremely unfair, as indicated by the paper titled “ Which Tax Policies For Lebanon?” Published by Arab Reform Initiative in May 2021.

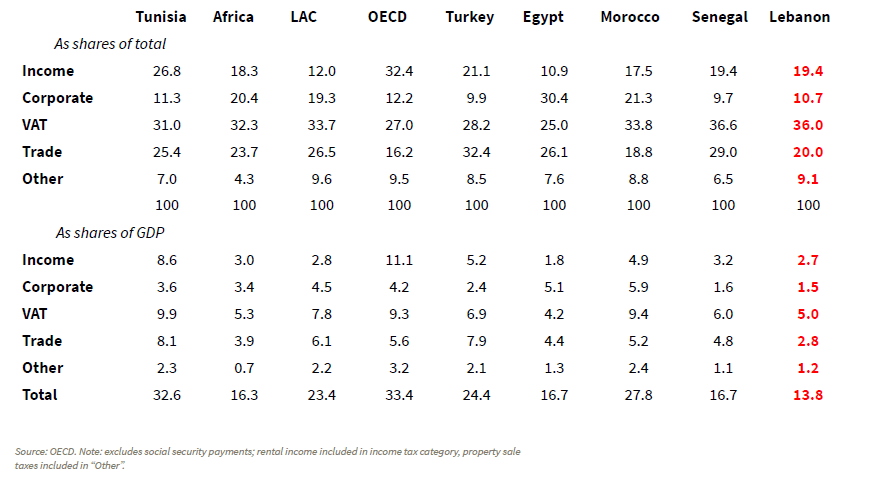

Lebanon has an insufficient taxation regime. Despite several historical waves of mini reforms on the taxation level, Lebanon still has very low tax revenues comparing to regional and poorest countries and it is in turn incapable to finance effective basic public services. As such, almost 15% of GDP represents the tax revenues in Lebanon by 2018 while Egypt has the closest tax revenues with 16.7% and Senegal and Costa Rica have similar tax revenues. However, much poorer countries have higher tax revenues, such as Sub-Saharan Africa (17%), Morocco (27.8%), and Tunisia (32.6%).

Furthermore, tax system in Lebanon is un-equalizing, unfairly targeting the middle class and the poor with very limited incidence on the rich class. The system depends extremely on indirect taxation; value added taxes, excise taxes and tariffs. Not to mention that indirect taxes are significantly regressive and only 11% represents the share of revenues collected through a progressive scheme. Only wages, property income, and inheritance are taxed as per progressive rates, whereas firms’ profit, interest earning, and capital gains and dividends are taxed at flat rates.

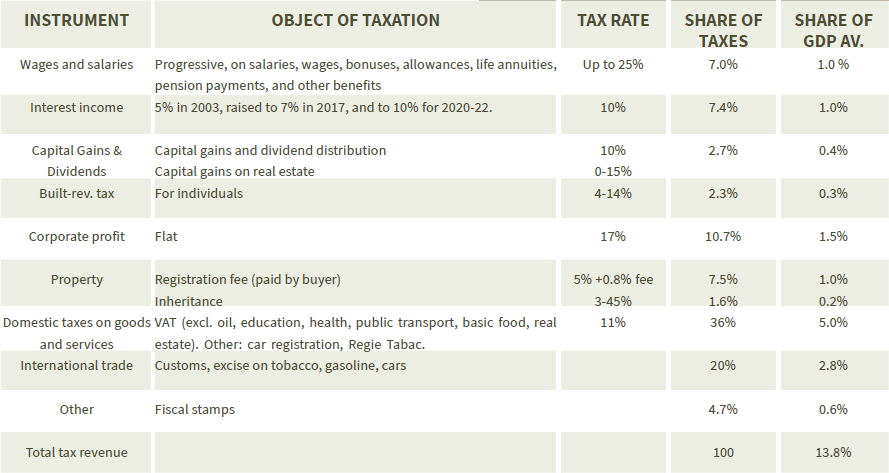

The tax rates, share of taxes and share of GDP in Lebanon:

Source: Which Tax Policies For Lebanon by the Arab Reform Initiative, MoF

At the comparative level, Lebanon has the lowest revenues from corporate taxes compared to historical and international standards and peer countries. As such, the tax grips 11 % of total revenues or about only 1.5% of GDP with Egypt and Morocco have larger share of revenue from taxing firms, while Tunisia and Turkey are likely to be close to Lebanon. However, all these countries end up with larger revenues compared to Lebanon.

Comparison of tax structure, Lebanon 2015, and other countries:

Moreover, the tax system is particularly leaky in Lebanon. Tax revenues could increase by 50% or 6-8% of GDP only if properly collected. The collection of taxes is particularly ineffective. The VAT and customs by itself could potentially rise in revenue by 3-4% GDP once the borders are rigorously controlled. Moreover, very limited fraction of real incomes is appropriately declared. In fact, accurately collected income tax could also raise an extra 2-4% GDP. It is worth mentioning that one major obstacle for the tax collection is the banking secrecy law in Lebanon. Tax revenue among the liberal professions, capital gains earned abroad by residents, inheritance tax, capital and real estate inheritance, are all extremely difficult to collect due to “the banking secrecy law” that prohibit effective control on banks accounts leading to the loss of key sources of revenue and a lot of tax avoidance.

In short, Lebanon clearly does not raise enough resources from tax revenues and reforms are widely required to improve collection of taxes. Structure of taxes must be also revised as it is much more placed on labor taxpayers than on liberal professions while also tax avoidance is much easier for richer taxpayers. More importantly, tax increase is surely to be avoided in a collapsing economy, whilst taxes must be collected properly instead from a reformed and well-functioning economy so as to be able to undertake public investments and social expenditures and also to afford the interest on the newly restructured debt.