As Lebanon’s financial crisis worsens, the Lebanese became increasingly dependent on the financial support from family members abroad. In the last year, remittance inflows constituted a lifeline for many struggling families and communities. In turn, the country became the second top remittance recipient in the world in terms of percentage of GDP. According to the World Bank, in 2022, the remittance inflows in Lebanon are estimated at 38% of the country’s GDP, a significant jump from 25.6% and 14.4% respectively in the years 2020 and 2019.

Remittance flows to developing regions were shaped by several factors in 2022. First and foremost, a robust pace of growth in remittances is evidence of migrants’ determination to help their families back home. Second, the gradual reopening of various sectors following Covid-19 pandemic, that has improved many migrant workers’ incomes and employment situations, and their ability to send money home. Third, the inflation resulting from the war between Ukraine and Russia. Fourth, the variation in currency exchange rates affects remittance flows. For example, in the case of Lebanon, the national currency has lost more than 95% of its value and citizens are increasingly emmigrating to other countries, consequently expats are sending more money home.

Looking at the Middle East and North Africa (MENA) region, it was severely exposed to the unfavorable conditions of the global environment. Notably, the sharp rise in oil and critical non-oil commodity prices are exacting a direct toll on developing MENA economies. In fact, MENA region suffered immensely due to Russia’s war in Ukraine as it imports more than 50% of its wheat requirements. Therefore, the disruptions of wheat and other agricultural exportation from these two major exporters escalated food insecurity globally in times where international food and input prices are already high and vulnerable.

Furthermore, exchange rate depreciations have come to amplify inflation in domestic currency terms, leading in several MENA countries to a tightening of monetary policy and increasing financial fragility. Double-digit inflation is now witnessed in Algeria, Egypt, and Tunisia, with Egypt experiencing a 15% inflation in September 2022 (YOY), reinforced by a 20% devaluation of the Egyptian pound in spring 2022. In addition, Lebanon is currently facing three digits inflation rate. Therefore, rising prices in general underpin the urgent need for additional funding from remittances to cover heightened living expenses.

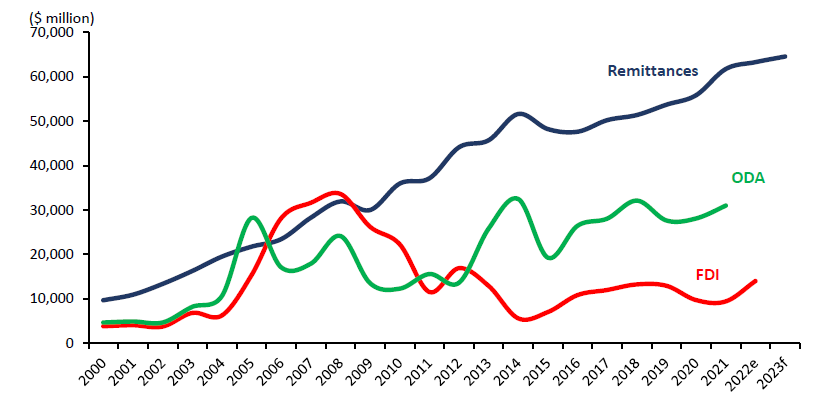

Figure 1: Remittances to MENA offer Support against High Volatility of Other Flows, 2000-2023f

Source: World Bank, Migration and Development Brief 37, “Remittances Brave Global Headwinds”.

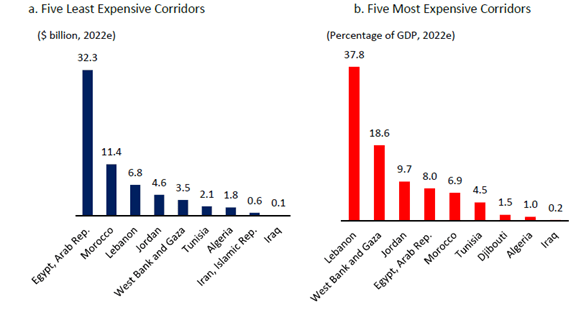

Since 2009, remittances have constituted the largest source of external resource flows for developing MENA, accounting for 60% of total inflows in 2022. Remittances and Official Development Assistance (ODA) are likely to remain paramount for the region into the medium term, given the uncertainty that the war in Ukraine has transmitted to the global outlook. For Lebanon, the West Bank and Gaza, and Jordan, remittance from overseas migrant workers is expected to sustain household consumption while diminishing the severe effects generated by the crisis. In more details, in 2022, the remittance inflows from Lebanon, West bank and Gaza and Jordan is expected to reach respectively 37.8%, 18.6% and 9.7% in terms of GDP. In the same token, in 2022, remittance to Egypt reached the highest value of $32.3B in the MENA region, followed by Morocco at $11.4B and Lebanon at $6.8B.

Figure 2: Top Remittance Recipients in the Middle East and North Africa, 2022e

Source: World Bank, Migration and Development Brief 37, “Remittances Brave Global Headwinds”.

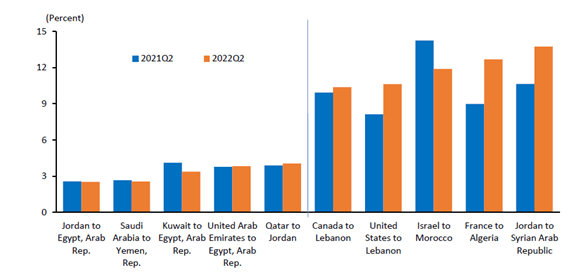

Looking at Remittance costs; the cost of sending $200 to the MENA region declined on average by 0.2% in the fourth quarter of 2021, compared to a year earlier, which is the largest decline in costs among developing regions. However, costs vary greatly across corridors; in fact the cost of sending money from high-income countries to MENA countries stand in double digits. For example, the cost to send remittance from Canada and United States to Lebanon is most expensive at more than 10%. Nevertheless, sending money within the region (including GCC countries) remains low, ranging below 3% in some corridors.

Figure 3: Sending Money within MENA is Less Expensive than Sending Money from Outside

a. Five Least Expensive Corridors b. Five Most Expensive Corridors

Source: World Bank, Migration and Development Brief 37, “Remittances Brave Global Headwinds”.

In conclusion, remittance flows is crucial for the economy of developing countries, more specifically to the MENA region. In fact, on a macro level, remittances support growth and on a micro level, they benefit recipient households by providing an additional source of income. In more details, remittances help recipient households to increase spending on essential goods and services, invest in healthcare and education, as well as allowing them to build their assets, both liquid and fixed, thereby enhancing access to financial services and investment opportunities.

Therefore, governments in developing countries are encouraged to ease all kinds of obstacles related to remittance flow while lowering their transactional costs. Furthermore, governments can design policies that encourage the use of remittances for investment purposes. In the case of Lebanon, while remittance inflows are crucial for Lebanese citizens, the country should take the opportunity to leverage expats remittances into productive assets.