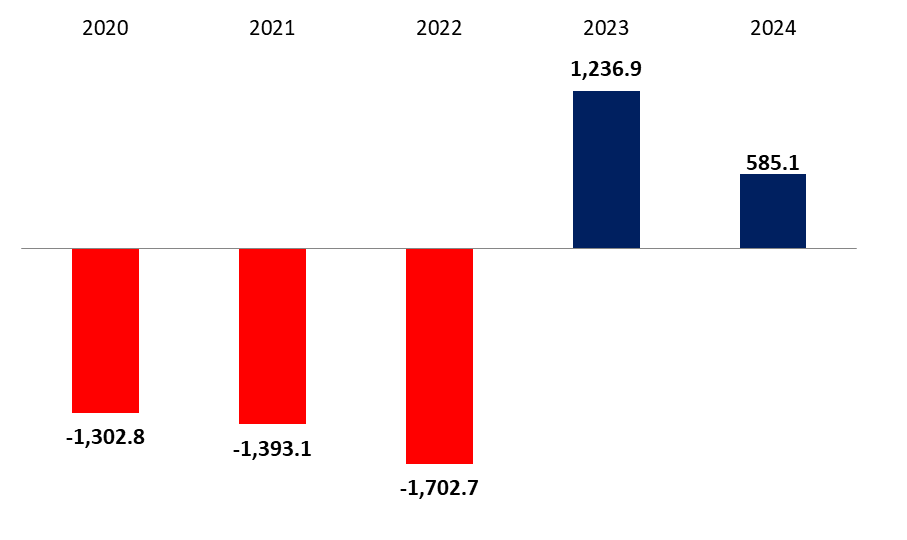

According to BDL’s latest monetary report, the BOP recorded a surplus of $585.1M by April 2024, far less than the surplus over the same period last year of $1,236.9M. Accordingly, Net Foreign Assets (NFAs) of BDL rose by $370.9M and the NFAs of commercial banks rose by $214.2M by April 2024.

For a meaningful analysis, we examine the NFAs of commercial banks for the month of April 2024. On the liabilities side, “Non-resident financial sector liabilities” dropped by $93.9M to reach $2.66B; while “Non-resident customers’ deposits” rose by 19.42M to reach $20.95B and “Non-resident debt securities” increased by $117.77M to stand at $150M by April 2024. Meanwhile, on the asset side, “claims on non-resident financial sector” decreased by $37.3M to reach $4.38B for the same period, “other foreign assets” declined by $20.01M to stand at $2.41B, and “claims on non-resident customers” dropped by $2.2M to reach $936M, while “Currency and deposits with other central banks” increased by $50.94M to stand at $784.97M.

Balance of Payments (BoP) by April 2024 (in $M)

Source: BDL, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.