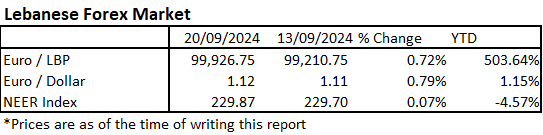

The Nominal Effective Exchange Rate (NEER) of the Lebanese pound inched higher by 0.07% this week against a basket of 21 influential currencies, including the US Dollar and Euro, and recorded 229.87 points on September 20th, 2024. Since the start of the year, we notice that the NEER Index fell by 4.57%. The decline is attributed to the US Dollar’s sharp decline this year, which led to a decrease in the Lebanese Lira’s valuation against other currencies since the Lebanese Lira’s conversion rate to the US Dollar has been stable since January 2024.

In international currency markets, the US Federal Reserve’s 50 basis point interest rate cut sparked a domino effect across forex markets.

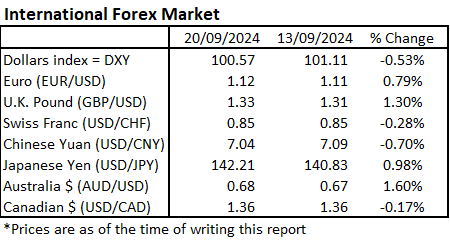

The US Dollar index, a measure of the US currency’s strength against a basket of six rivals, decreased by 0.53% this week to 100.57 points, to trade near its lowest level since July 2023. This decline is attributed to the Fed’s jumbo rate cut as rate reductions typically lead to a weakening currency.

The sterling soared to its highest level in two and a half years following the Bank of England’s decision to keep its interest rate steady, in contrast to the Federal’s big rate cut, despite the BOE’s signal that it entered a rate-cutting cycle. The pound increased 1.3% over the course of the week to reach 1.33.

The Japanese yen weakened against the dollar to equal 142.21 JPY for 1 US Dollar compared to 140.83 JPY last week as the Bank of Japan kept short-term interest rates at 0.25%, indicating a moderate recovery in the economy while cautioning that “high uncertainties” persist regarding the outlook for both activity and prices.

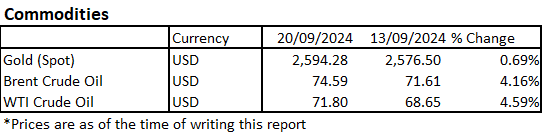

In commodity markets, both oil benchmarks rose this week supported by demand optimism that was fueled by the Fed’s half point cut. This decision is expected to stimulate economic activity and increase oil demand. Additionally, potential supply risks that resulted from rising Middle East tensions also supported oil prices. Walkie-talkies and pagers used by Lebanese armed group Hezbollah blew up earlier this week. The party accused Israel of being behind this wave of explosions, but Israel did not admit to the attack. This attack raised concerns about the involvement of Iran, a major oil producer, in the conflict.

Brent crude, the global oil benchmark, jumped 4.16% this week to $74.59 a barrel and West Texas Intermediate, the US equivalent, increased 4.59% during the same period to $71.8 a barrel.

As for metal markets, Gold traded near it highest level ever this week after the Federal Reserve’s recent big interest rate cut and on signs that additional reductions would follow. Lower U.S. interest rates, a weakening US Dollar and geopolitical uncertainty usually drive gold prices higher. The yellow metal increased 0.69% this week to $2,594 per ounce on Friday.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.