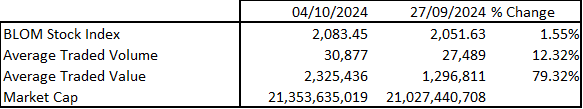

The BLOM Stock Index (BSI) compiled by BLOM Invest Bank daily increased weekly by 1.55% to reach 2,083.45 on October 4th, 2024, defying expectations.

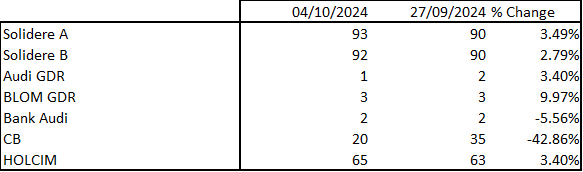

On the Beirut Stock Exchange (BSE), the real estate sector grasped the lion’s share of the BSE’s trading value with a stake of 99.15%, while the banking sector came next with a 0.63% stake, and the industrial sector’s share was 0.22%. The most noteworthy trades throughout the mentioned period included:

![]()

As for the BLOM Preferred Shares Index (BPSI), it remained constant at 27.78 on October 4th, 2024.

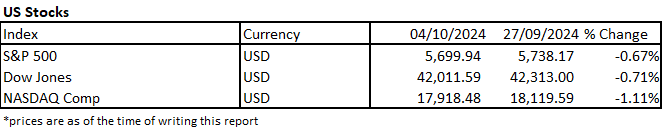

Moving to the global markets, U.S. stock markets faced downward pressure this week, with major indices reflecting investor concerns amid rising geopolitical tensions in the Middle East. This downturn coincided with President Biden’s suggestion of support for Israel’s potential strikes on Iran’s oil facilities, which contributed to a weekly surge in oil prices of about 8%. Such geopolitical developments have heightened market volatility, leading to decreased investor confidence and a cautious approach as traders anticipate further escalations in the Middle East conflict and their potential economic implications.

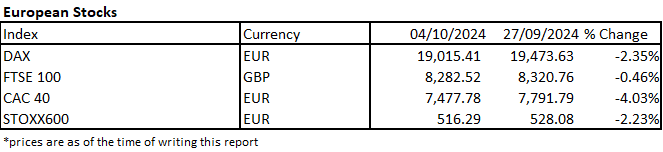

Across the Atlantic, European stock markets experienced a decline this week, with major indices such as the DAX, FTSE 100, CAC 40, and STOXX 600 all reporting negative changes. CAC 40, the French index, saw a significant drop of 4.03%, to 7,477.78, while the German index DAX fell by 2.35% to 19,015.41. This downward trend reflects rising geopolitical tensions and a diminishing enthusiasm for the Chinese economic stimulus, which have led to investor uncertainty.

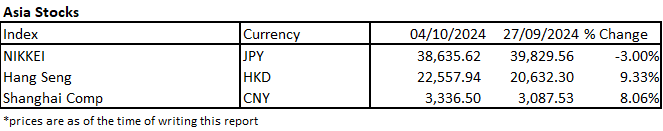

In Asia, stock markets displayed mixed performance this week, with notable divergences among major indices. The Nikkei dropped 3% to 38,635.62, reflecting broader market concerns amid geopolitical tensions. In contrast, the Hang Seng Index surged by 9.33%, to at 22,557.94, driven by optimism surrounding China’s recent stimulus measures aimed at revitalizing its economy. The Shanghai Composite increased by 8.06% to 3,336.5, although mainland markets remain closed for the Golden Week holiday.

![]()

As for the MSCI Emerging Market index, it scored some weekly gains and rose by 0.47% to reach 1,180.

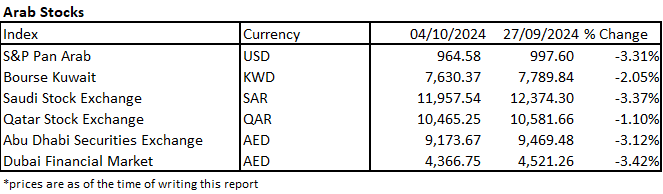

Arab stock markets faced declines this week, led by the declines of the Dubai Financial Market Index and Saudi Stock Exchange Index by 3.42% and 3.37% respectively. This overall downturn reflects investor concerns amid rising geopolitical tensions.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.