This economic digest discusses the presentation by Mr. Pierre-Olivier Gourinchas, the Economic Counselor and the Director of Research of the IMF, for the World Economic Outlook. Mr. Gourinchas states that after the inflation returns to the level targeted by Central Banks, it is time for a “policy triple pivot”, being monetary policy, fiscal policy, and growth-enhancing reforms. This provides a much required macroeconomic breathing room as risks and challenges remain high.

The first pivot is the monetary policy pivot, already began as major Central Banks started their monetary easing through cutting rates led by the European Central Bank (ECB) back in June, and followed by the Federal Reserve. This monetary easing was supported by decrease in inflation reaching close to Central Banks targets. Despite the tight monetary policy previously applied by major Central Banks, the global economy growth stayed robust forecasted at 3.2% in 2024 and 2025.

The rise and subsequent drop in inflation resulted from broad supply disruptions along with strong demand pressures following the end of the pandemic, tracked by acute rise in commodities prices after the Russian – Ukrainian war that initiated in February 2022. These shocks resulted in a vertical upward shift in Phillips curve (relation between activity and inflation). The justification for the decrease in inflation without the experiencing a global recession is attributed to the easing of supply interruptions and strict monetary policy that led to ceiling demand, stabilization in labor markets allowed quick drop in inflation without significant slowdown in output.

Although inflation is decreasing, there are several downside risks that are rising such as escalation in geo-political risks that might affect the commodities market, especially the conflicts in the Middle East. In case these conflicts persisted, shifts towards adverse trades will drastically lower output compared to baseline expectations, thus keeping monetary policy tight for a longer period. The graph below shows the World Economic Outlook and IMF staff estimates regarding potential risks and its consequences on global output.

The interest rate cuts happening in major Central banks will have positive impact on emerging markets, as their currencies will appreciate against the US dollar, thus will result in lower imports inflation. However, services inflation remained high in these countries and almost double the level before the pandemic.

The second pivot is the fiscal policy, as it is a major foundation of macroeconomics and financial stability. It is the time to alleviate debt dynamics and restore required fiscal buffers, as the decrease in interest rates (funding costs) alone will not be sufficient to fiscal relief. The success receipt is applying persistent and trustworthy multi-year adjustments immediately. It seems that there is a lack of willingness or ability to provide thorough and reliable fiscal adjustments that allow monetary policy to support easing policy rates while keeping inflation under control.

The third pivot is the growth-enhancing reforms. This is the toughest and most important method to improve growth prospects and lift productivity in order to address many challenges that the world is facing such as dealing with climate changes, rebuilding fiscal buffers, and handling aging and shrinking populations. China’s weak economic outlook accompanied with Latin America and European Union fading medium-term projections result in 3.1% growth forecasts, the lowest in decades. The article states that instead of the current applied industrial and trade policy measures that are effective in boosting investment and activity in the short-term through debt-financed subsidiaries, determined domestic reforms is needed that lift technology and innovation, develop competition and resources allocation, more economic incorporation, and fuel productive private investment. Unfortunately, these reforms are facing social resistance, however, by building trust between the governments and its citizen and including proper compensation to offset the harm the latter might encounter, policymakers can gain the support they need for implementing these reforms.

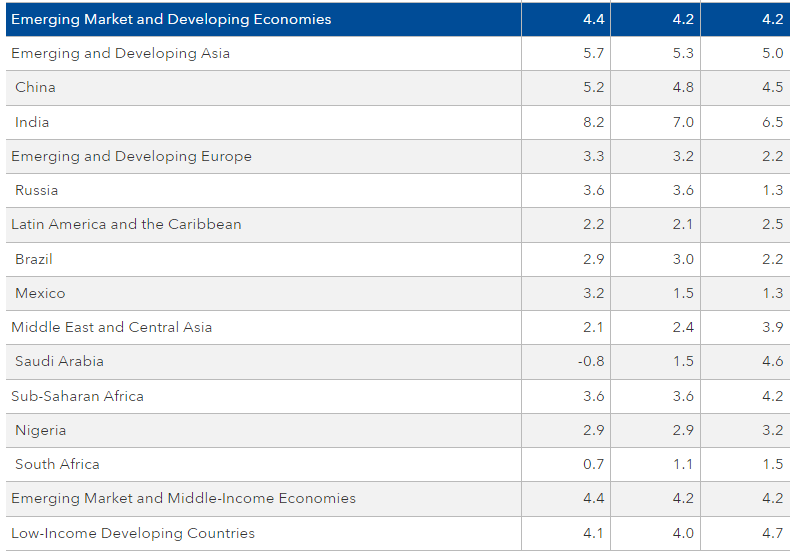

Finally, the tables below show world economic outlook projections for advanced economies, and emerging markets & developing economies.

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.