| 24/10/2024 | 17/10/2024 | Change | Year to Date | |

| BLOM Bond Index (BBI) | 7.08 | 7.22 | -1.94% | 17.41% |

| Weighted Yield | 218.84% | 209.09% | 4.66% | 149.19% |

| Weighted Spread | 21,426.49 | 20,451.60 | 4.77% | 144.15% |

| 24/10/2024 | 17/10/2024 | Change | |

| JP Morgan EMBI | 900.23 | 908.87 | -0.95% |

| 5Y LEB | 88.90% | 87.20% | 170 |

| 10Y LEB | 83.70% | 82.20% | 150 |

| 5Y US | 4.03% | 3.90% | 13 |

| 10Y US | 4.21% | 4.09% | 12 |

| 5Y SPREAD | 8,487 | 8,330 | 157 |

| 10Y SPREAD | 7,949 | 7,811 | 138 |

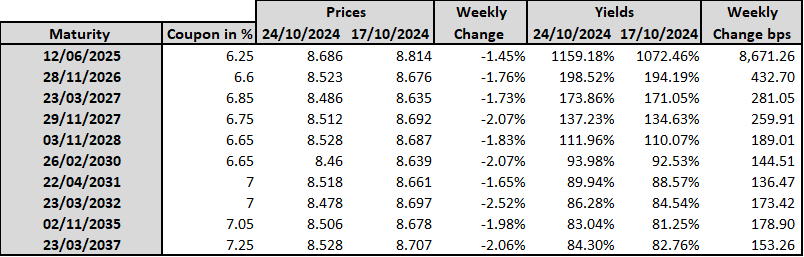

The BLOM Bond Index (BBI), which tracks Lebanese government Eurobonds (excluding coupon payments), dropped by 1.94% this week to 7.08 points, reflecting increasing investor concerns about Lebanon’s economic stability, particularly amid rising humanitarian needs and ongoing conflict. Nasser Yassin, Lebanon’s Emergency Committee Coordinator and caretaker Environment Minister, announced at the Paris conference that Lebanon needs $250 million monthly to support over one million displaced people due to ongoing conflict. So far, only 20% of the needed aid has been secured, and as daily attacks continue, the number of displaced individuals is likely to rise. There have been demands for an immediate ceasefire from the Lebanese side, but no agreement has been reached yet.

While BBI’s Year to Date performance remains strong at 17.41%, however, the index’s decline suggests that investors are increasingly cautious of future developments and potential defaults. This situation prompts investors to cut back on their bond holdings leading to a decrease in Lebanese Bonds prices.

As bond prices decrease, yields increase. Consequently, the yields on 5-year and 10-year Lebanese Eurobonds rose this week by 170 and 150 basis points, respectively, reaching 88.9% and 83.7% by October 24, 2024.

Similarly, in the U.S., the yield curve shifted upward this week, with one-year, five-year, and ten-year yields rising by 4, 13, and 12 bps, respectively, to stand at 4.25%, 4.03%, and 4.21% on October 24, 2024. The benchmark 10-year Treasury yield jumped to 4.26% on Wednesday, its highest level since July.

This increase is driven by signs of a stronger economy, as initial jobless claims recorded 227,000 for the week ending October 19, lower than the Dow Jones estimate of 245,000. These positive indicators could lead to smaller interest rate cuts in the Federal Reserve’s upcoming meetings.

Additionally, former President Donald Trump’s rising chances of winning the upcoming election have raised concerns about potential deficit-boosting policies, which could affect long-term debt sustainability and lead to higher inflation levels. As a result, investors may demand higher yields on bonds to offset these risks, leading to a sell-off in the bond market and lower bond prices.

These developments have led analysts to reconsider the likelihood of aggressive rate cut possibilities. Traders are now pricing in a 95% chance of a quarter-point rate cut at the Federal Reserve’s November meeting, while the likelihood of no change is just 5%, according to the CME Group’s FedWatch tool.

| 5Y Credit Default Swaps (CDS) | ||

| 24/10/2024 | 17/10/2024 | |

| KSA | 66.91 | 66.05 |

| Dubai | 65.80 | 65.99 |

| Brazil | 161.35 | 156.61 |

| Turkey | 274.87 | 268.44 |

| Source: Bloomberg | ||

Disclaimer:

This article is a research document that is owned and published by BLOMINVEST BANK SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of BLOMINVEST BANK SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither BLOMINVEST BANK SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.